“Close your eyes, breath in slowly through your nose and then out through your mouth.” – We were guided through breathing mediation technique on the second morning of ESOMAR APAC 2018 Conference held in Bangkok in mid-May. A refreshing take for a research conference, the mediation session led the participants into first-hand experience and insight into the Thai culture that has an emphasis on inner reflection and self-awareness – a practice of Buddhism. Their beliefs and outlook towards life are one of the reasons why Thai consumers always appear so positive with a smile on them. Simply recall some of your past consumer research studies and market trends in Thailand and I’m sure it is not difficult to notice that there was not much negativity flagged.

“Land of Smiles”, Thailand is known for its tourism industry. Beyond the hospitable smiles lies a strong and unique Thai culture that shaped the consumer behaviour and market trends across industries that we see today in Thailand. Contrary to the Western culture in which smile is an expression of happiness, a smile in Thailand could mean many different things. Thais smile when they are feeling happy, embarrassed, awkward, confused or even angry. Depending on the situation, the smile could be linked to a reflection of self-control or their “Mai Pen Rai” (It doesn’t matter) mentality. Understanding the cultural rationale behind these smiles give us insights into consumer behaviour that would aid business success in the Thai market.

Often time, brand marketers are satisfied with knowing the market trends that would help them play catch-up game or stay ahead of the competition. Do we find ourselves questioning enough about the reasons why these trends are happening in the market? With major trends being similar across markets in the region, what are the subtle differences in Thailand that would deliver an impact?

In this article, I am getting behind 5 major market trends in Thailand and shed light onto the deep-rooted Thai culture that is shaping these trends and the respective implications for brands.

As with most developing markets, Thailand is experiencing a growing middle-income segment. True to good, old Maslow theory, rising affluence gives rise to higher demand for small indulgences once basic needs are being fulfilled, followed by spending on luxury and experiences for self-actualization. At first glance, there is nothing unique or different from what we see in other South East Asia markets. However, Thailand’s higher propensity to spend, as evident through the higher debt ratio in the region, could be traced back to their belief of living in the present.

Unlike Western culture of reflecting back at the past for lesson into the future, the Thais’ belief is shaped by Buddhism belief that life exists in the present. With the saying of “The past has passed, the present is a gift, and the future may never arrive”, the Thais believe in enjoying the present moment – something that they really can control. With the younger generation, we are seeing an amplified effect on the propensity to spend on experience and instant gratification.

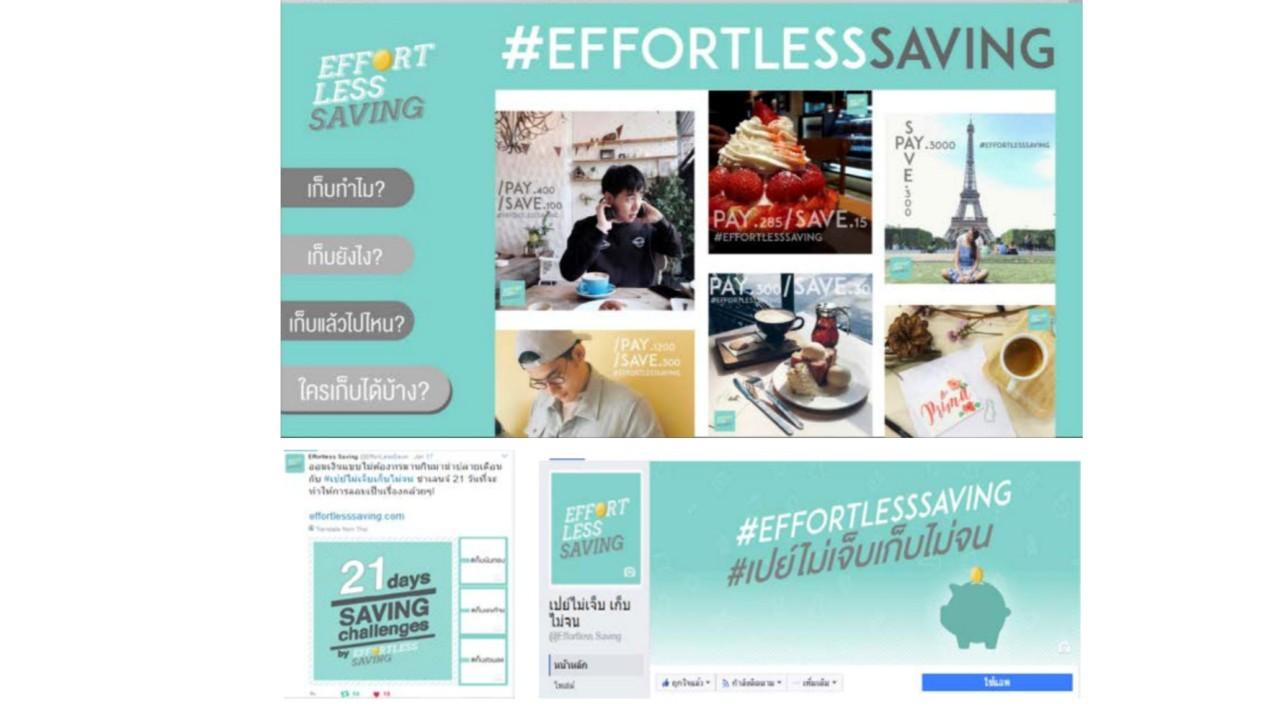

Brands would be in a better position to communicate the pleasure of living in the moment, and this would sit particularly well for categories of light indulgences. This is true even for categories that seem to contradict the idea of “living in the moment”, for example banking, contrary to other parts of Asia where a saving culture is stronger. Asian Development Bank (ADB) was able to deliver “saving is cool” for first jobbers through a portrayal of being a lifestyle guru.

Asian Development Bank (ADB) #EffortlessSaving

In a survey conducted by the National Statistical Office in 2012, 50,000 Thais ranked “Health” as the most important measure of life satisfaction and happiness among other factors like family, housing livelihood, job, education and societal relationship. That explains why Thais typically pray for health, fortune and wealth during their temple visits. Health is wealth. The Thais believe that with good health, they are avoiding financial complications and burden which could otherwise hinder them from enjoying the present.

Clearly, there is a want for good health, even among the younger Thai consumers. People want to stay healthy and look good, but the vast majority of the population does not exercise on a regular basis as shown in one of our recent study involving the Thai consumers. That’s where healthier food options, supplement products and health-related services like gyms and plastic surgery clinics gain popularity. CP Balance’s line of low calories ready-to-eat meals perfectly captured this effortless healthiness without the need to restrain oneself from indulgences.

Young Thai consumers also demand good health

While this clearly represents opportunities for brands in health-related categories, not all is lost for brands in other categories. Health to the Thais does not only mean physical health but also includes mental and spiritual well-being and a positive mindset. For brands that are not in the health-related categories, you could still leverage the importance placed on health as a measure of happiness for communication of emotional benefits.

Convenience stores could be seen at every street corner in Thailand. The biggest player, 7-Eleven, alone has 10,000 outlets, selling products to 30 million customers per week in Thailand. Growing urbanization and worsening traffic conditions, especially in Bangkok, are driving demand for convenience – convenience packaged food, convenience service, and convenience stores.

The immediate takeaway for this convenience trend points towards a shopping habit of more frequent trips and lesser items along the route of their workplace and home for the time-starved Thais. However, if we were to dwell deeper, it is not the immediate benefit of time-saving that the Thais are shopping at convenience stores. It is the collective nature of the Thais that shaped their attitude towards life and time spent. Time is best spent enjoying the moment with family and friends instead of shopping in hypermarts. Hence, trying to sell a product based on saving time would not be as appealing as one that showcases how convenience allows for them to enjoy themselves more.

Living in the moment, coupled with the “Sabai Sabai” (relaxed, being comfortable) attitude, the Thais lead a carefree way of living. This carefree way of living is not for self-actualization, but must be communicated to exemplify the pleasure. This is especially true among the younger generation who are active on social media. Take Facebook as an example, there are 47 million Facebook users, representing 70% of the Thailand population. Interestingly, Siam Paragon topped the chart as the most Instagrammed place in the world when it first opened up in Bangkok back in 2013. Talk about being in-trend.

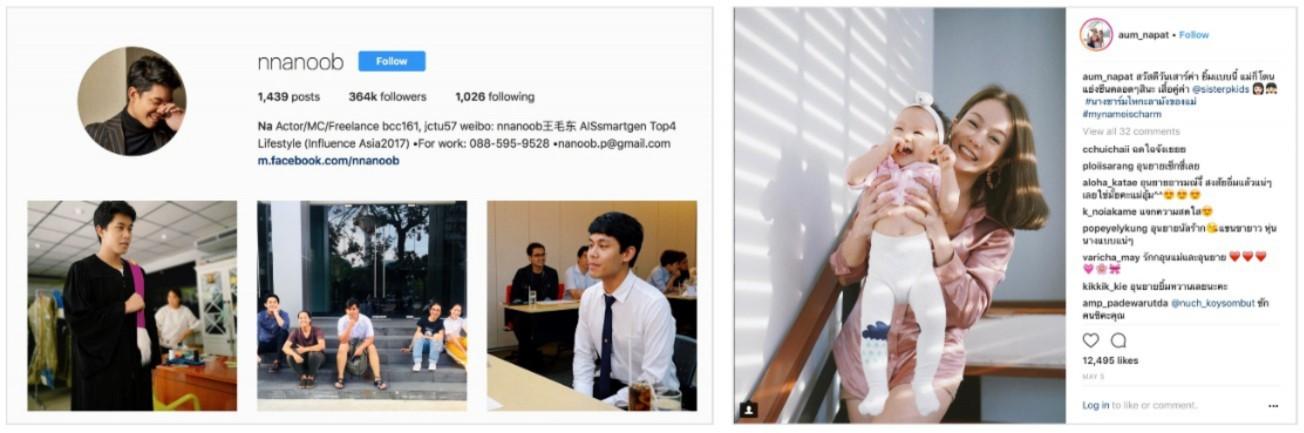

The high usage of social media and increasing trust in “friends” over traditional advertising have given rise to a vibrant industry of micro-influencers. Thailand has no lack of micro-influencers across different topics like food, lifestyle, travel, fashion, parenting, and many of these micro-influencers are still under the radar of big brands.

micro-influencers on social media

So what gave rise to the huge number of micro-influencers? Based on a research conducted by Thailand Market Research Society, the younger generation (18 to 26 years old which represents 21% of the population) do not see their job as a career, but as a means to get money. Ambitious and ready to take risk, they prefer to control their own destiny with freelancing or being an entrepreneur as ways to have their work-life balance.

For brands looking to strive in Thailand, instead of celebrity endorsement, consider the engagement of these micro-influencers who tend to take on a more personal approach in sharing about your brand to their network of followers on the digital space.

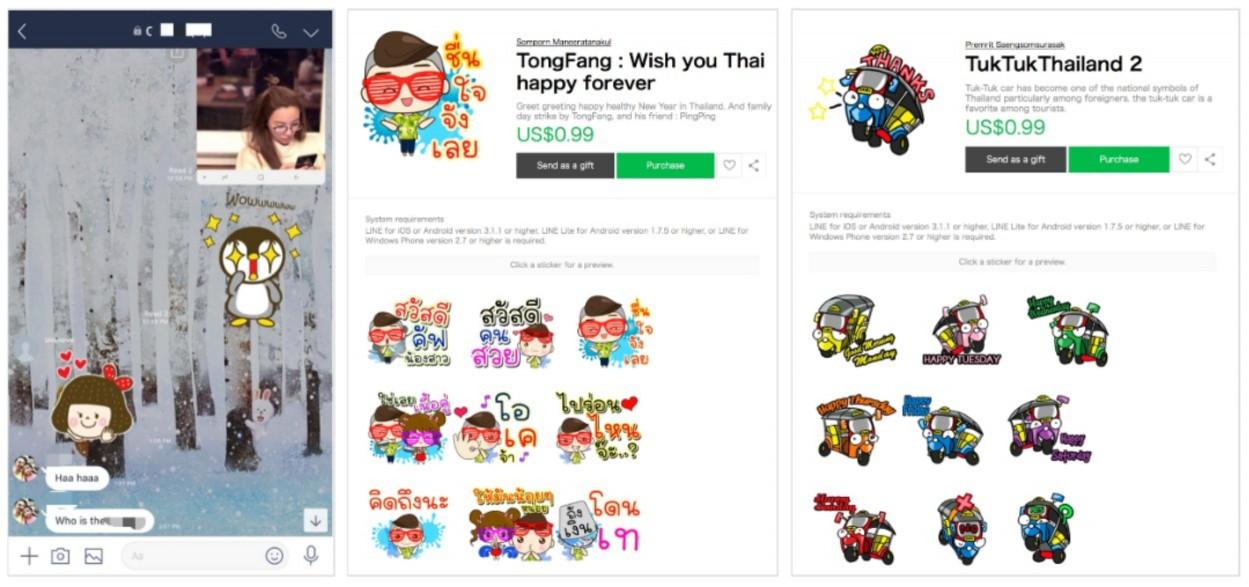

The Thai spend on average 70 minutes, a third of their time spent on mobile, on LINE daily. There are 44 million mobile internet users, which 41 million (94%) are LINE users, making Thailand LINE’s second largest market in the world after Japan. This digital integrated platform is not just embraced by the young and savvy, but also the elderly. It is not difficult to find extended family chat groups, but what’s interesting is that close to 90% of the content in the chat would be stickers, not text or voice. One of the success factors of LINE could be attributed to the millions of stickers. Stickers are so popular in Thailand that they are even available for purchase from offline channels.

The Thais are very much visual-driven and entertainment value is very important to them. This could again be traced back to their attitude towards “sanuk” (fun). They believe that dull activities should be spiced up with a little playfulness, even in the aspect of work. Aligned with the “sabai sabai” and “mai pen rai” (Don’t worry, be happy) beliefs, they tend to be able to share little jokes and fun moments with family and friends. This is also why we see so many TV commercials in Thailand with a humorous spin. Enjoy the moment and “mai pen rai”.

Fun Line stickers

With that, brands need to bear in mind to keep communication direct and simple, but yet fun and interesting enough. Sometimes, less is more and visual works better than all the text one could have.

Knowing the “WHATs” of market trends would direct brands to immediate implications, but understanding the “WHYs” of consumer cultural behavior behind these trends would equip brands with long-term knowledge that is applicable across categories and time. Finding consumer insights involves getting to the roots of cultural behavior and uncovering how these have changed with the changes in the market – something that trend reports don’t usually reveal.

Avoid hefty pitfalls by jumping onto trends bandwagon without a true understanding of your target audiences. Conducting research could take a month or more, but that could potential save you from hefty pitfalls. I could not emphasize enough the importance of “WHYs” behind the “WHATs”.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.