Discover the power of brand-led market research in the dynamic landscape of the Chinese economy. From the historical significance of agriculture to the dominance of manufacturing, China’s economic evolution has been remarkable. Since Deng Xiaoping’s open-door policy in 1978, manufacturing has played a pivotal role, attracting global companies to establish production bases in China. As the steel industry experienced substantial growth, it exemplified the nation’s industrial prowess. Embracing brand-led market research is essential for businesses seeking to navigate and capitalize on China’s market opportunities. (Diagram 1)

Diagram 1

Now again, market dynamics are changing, for three main reasons:

As in any country, China’s best and brightest follow the money.

Marketing and Branding Strategy in the era of manufacturing was very simplistic. The key was to push your product, idea, or brand onto as many people as possible. “Build it and they will come” was the pervasive mentality.

Now, with a population of 1.4 billion and growing, consumers in China are becoming more stratified. Their tastes are more unique and their standards are higher. It is useless to just “push” product on consumers – they have unlimited options when choosing what will suit their need, so breaking into a category or growing your brand’s profitability means stealing market share through specific and strategic niche targeting.

A brand, and its offerings, must “pull” consumers in with unique functional and emotional benefits that are uncovered during research, usually qualitative techniques. Our research shows that these emotional benefits become more and more important as leading brands build strong relationships with consumers in China, paving a different and more mature way to brand loyalty.

In so many words, consumers in China are now more attune to what the brand – rather than just the product – can bring them. So the question becomes how to leverage this.

The answer is simple: ask! Pinpointing emotional benefits of a growing segment through research is the only way to ensure relevancy to your audience. We find ourselves in the age of Consumer Collaboration – people want to be heard. They want to know that a brand is listening and tailoring their offerings, to a certain extent, from that insight.

Consider Rexona, a deodorant brand of Unilever, the largest deodorant supplier in the world. Rexona was troubled by a lack of consumer responsiveness. So, they set out to understand the market and collaborate with consumers through Focus Groups and Digital Customer Communities, a unique MR tool that functions as a medium-population online discussion platform, measuring attitudes and perceptions over several weeks. It turned out the core problem was actually with the cognitive mapping of the product category.

The original category name, 止汗香体 [zhĭ hàn xiāng tĭ], implied blocking/stopping sweat and spawned health concerns – respondents noted that while sweating can be uncomfortable and should not be noticed by others, “blocking” sweat was extremely unhealthy and suffocating to one’s body. Through our research methods we discovered that the feelings of freshness and confidence were most in tune with what consumers wanted – so, Rexona changed the category name to 爽身香体 [shuăng shēn xiāng tĭ], which evokes meanings of coolness, chillness, and a good-smelling body. Rexona realized increased profitability as a result.

Understanding how these emotional connections change over a consumer’s lifetime is the minimum for an agile brand. How do needs evolve with a job change, a family change, a living environment change? All of these directly impact consumption patterns and brand preference.

But collaborating with consumers does not mean you have to follow – sometimes the best method is to carve a path forward. (Diagram 2)

Diagram 2: The Leading Brand vs Following Brands

By looking at the past and analyzing in-depth what is happening right now, in terms of pop culture, macro trends, and overall product category preferences, brands can create product innovations that capture the attention and the loyalty of their target as they evolve. The stakes are high as shaping such preferences requires a mastery of the local market. But the rewards are even greater.

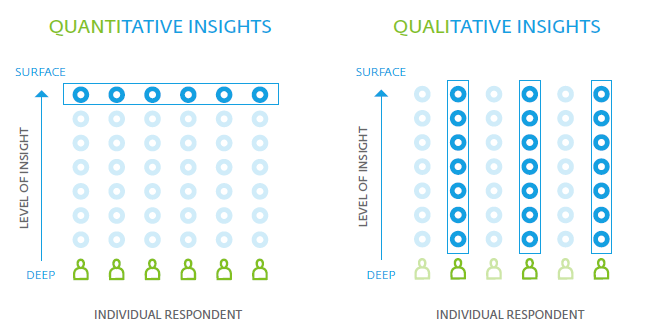

Whether your goal is product innovation or repositioning, market research provides the building blocks for a strong brand strategy. A question frequently asked in the MR realm in China is how to use quantitative research versus qualitative research to inform brand strategy development.

When comparing the two, quantitative gets all the attention. This may be because it has been around longer, is more commonly accepted, or because it is a more scalable business model for research agencies. But quantitative also has its limitations. (Diagram 3)

Diagram 3

Qualitative research is often used for more exploratory research objectives. The goal is to discover insights by talking to real people – unearthing their opinions, probing their answers, and eventually uncovering deep-seated trends that are the basis of a brand’s strategy.

The benefits of qualitative run deep as moderators have the opportunity to see how consumers react to stimuli both emotionally and physiologically, be it a newly designed logo lockup or a new type of on-the-go packaging. Quali gives the opportunity to grow customer intimacy by rooting brand strategy in consumer collaboration and brand co-creation.

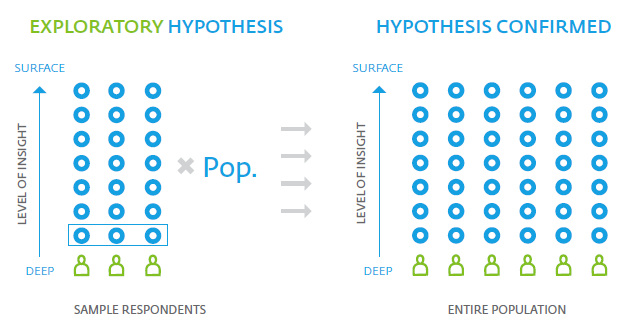

A research hypothesis comes from this deep-rooted research and oftentimes becomes the pillar for a strong brand strategy, but to have a hypothesis guaranteed, quantitative techniques are useful. Proving it correct can mean extrapolating insights about an entire target population – resulting in a true and complete understanding of how your audience thinks. (Diagram 4)

Diagram 4

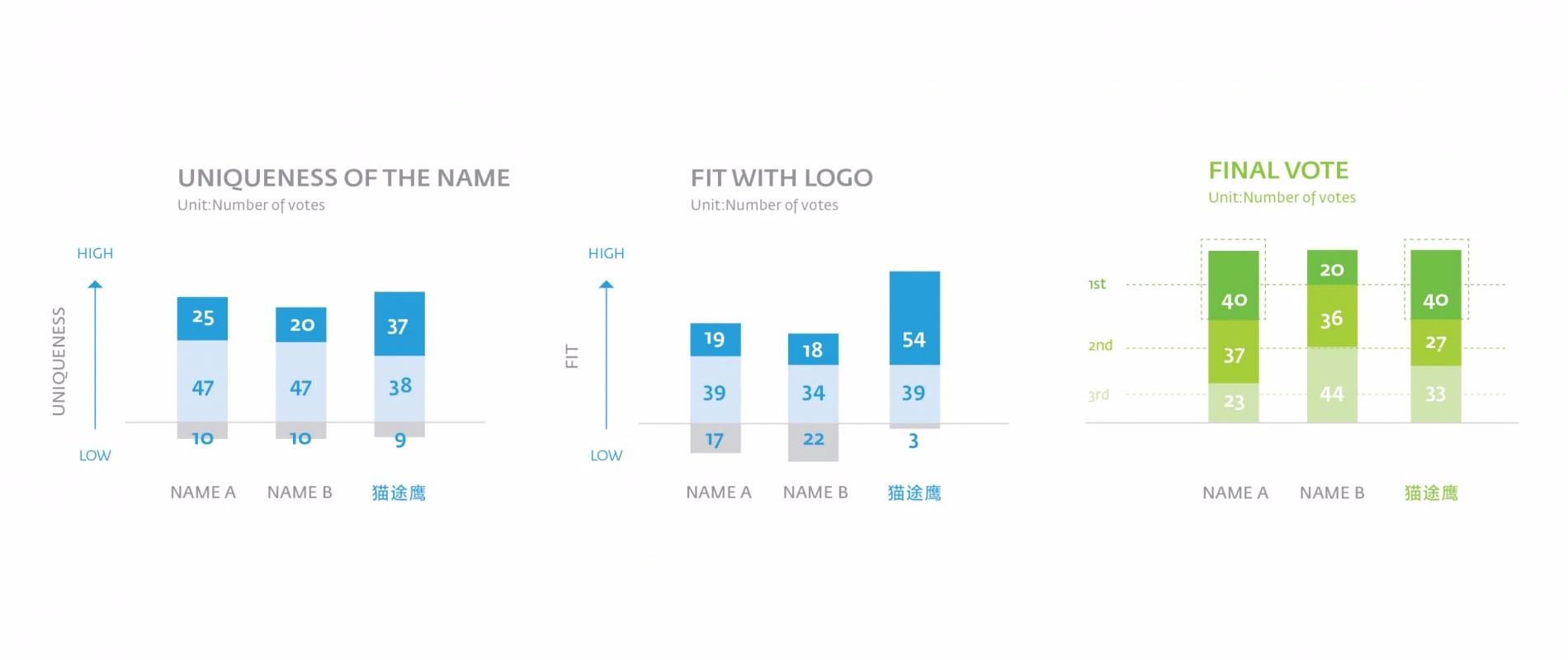

Consider the case we encountered with TripAdvisor. The global travel brand was facing stiff competition from local players who had years of experience building relationships with Chinese consumers. TripAdvisor decided to reposition at the core by renaming its brand in the context of the local market. So, they set out to understand local perceptions of travel.

Step one was uncovering Chinese perceptions of travel; through six targeted focus groups in three major regions around China, Labbrand probed to find three common themes: self-discovery, self-development, and enjoyment. We further collaborated to shortlist down to three names that were unique, consistent with travel, and evoked positive associations.

The tricky part for TripAdvisor came down to their targeting: a quantitative survey confirmed that preference was split by demographics. The data validated our hypotheses from the qualitative research that 猫途鹰 [māo tú yīng] is overall more unique, easy to remember, and an extremely strong fit with the Owl logo, which Chinese consumers adore. Since rebranding as 猫途鹰, TripAdvisor has seen increased awareness and site traffic amongst their Chinese audience (Diagram 5). Knowing your targets inside and out allows you to approach a new culture with confidence and conviction.

Diagram 5

TripAdvisor’s consumers’ starkly different opinions are hardly surprising. As the younger generation steps into the decision-making role, brands can expect a more stratified and opinionated consumer in China. Unlike past generations, these brand-centric customers pride price over frugality, exclusivity over commonality, and above all, their own unique image.

Pair this with an expected spending rate that is twice as high as that of the older generation, and it is clear that companies need to focus brand strategy budgets on research. What will be the next biggest home-grown trend in China? How will a newly wealthy population grow alongside a digital world? What major psychographic segments will emerge?

Brands must learn to evaluate both who they should target (which segments in China will be the most profitable) and how to do it (what are the smartest cultural levers to pull). Extracting answers during Focus Groups and discovering evolutions in Digital Customer Communities can together take on this task. At the end of the day, research simply serves as the bridge between brand and consumer.

For brands, this new era of consumerism in China is a good chance to develop more distinguished and unique brand elements, DNA, and offerings. As Freya Zhang, Associate Research Director at Labbrand states, “You can see now strong examples where if they have done good research on the target, then they build a relationship – engaging together, moving up together, and developing new innovation together.”

But don’t forget: it will also be a challenge for brands facing this new generation, so strong in self-expressions, so strong in energy and leadership. They want to be led by the brand that speaks to them. Do you have the insights it takes to guide the way?

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.