The massive potential for retail businesses in China is no surprise to anyone—least of all prestige brands. After years of annual double-digit growth, China’s booming economy has left tens of millions of consumers seeking new ways to spend their disposable income. In 2009, China became the world’s second largest luxury market behind Japan, surpassing the United States.

Even though these trends were recognizable at least 20 years ago, many prestige brands are still playing catch-up in this diverse and rapidly changing marketplace. With 384 million internet users—more than the U.S. and Japan combined—much of the competition for customers and brand loyalty will play out online. The investment prestige brands make in their own digital competence could be a deciding factor in their ability to survive and thrive in China, and is likely to become increasingly important as the market matures.

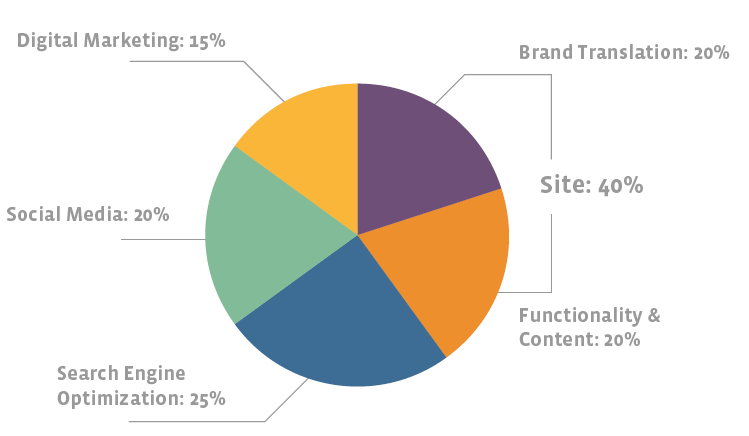

In July of 2010, L2, a think tank for prestige brands, partnered with Labbrand to measure and rank the digital competence of one hundred prestige brands in China1. The measurement methodology, “Digital IQ,” gives each brand a combined score based on website translation, functionality and content, search engine optimization (SEO), social media performance, and digital marketing efforts. A breakdown of how each of these components contributes to a brand’s overall score is shown in Figure 1.

Figure 1: Components of Digital IQ

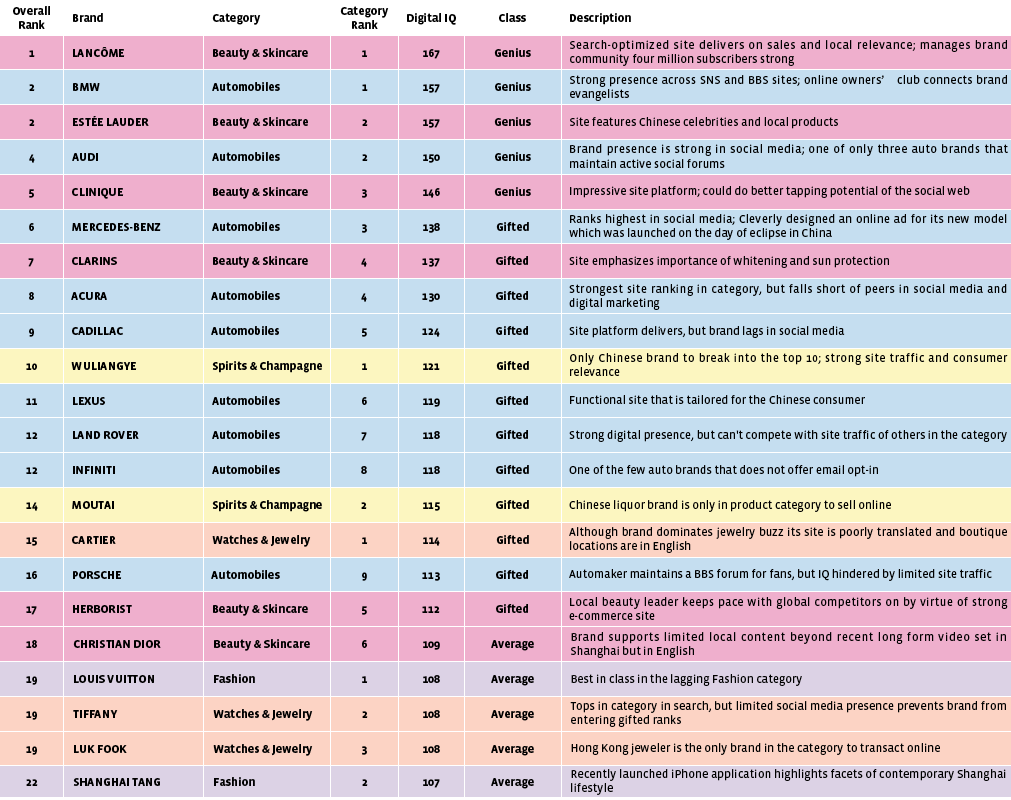

See full 100 brand ranking here.

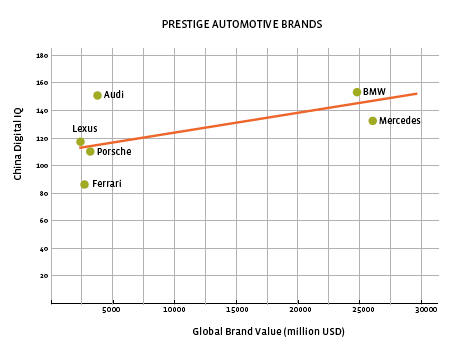

These rankings reveal several interesting trends and correlations with other available metrics. For example, the eight fashion brands measured show a strong positive correlation (0.72) between Digital IQ and brand value as reported in BusinessWeek’s annual 100 Best Global Brands report2 (Figure 2). For the six automotive brands measured in both studies, the correlation is also strongly positive, at 0.61 (Figure 2). These correlations do not necessarily mean that increasing Digital IQ guarantees an enhanced brand value. Nevertheless, the strength of these correlations suggests that the relationship between brand value and Digital IQ is not arbitrary. It is possible that valuable brands are more likely to have higher brand awareness, and therefore enjoy higher returns on the same or smaller investments in digital. Alternatively, valuable brands may be more likely to have higher marketing budgets and invest more heavily in digital media.

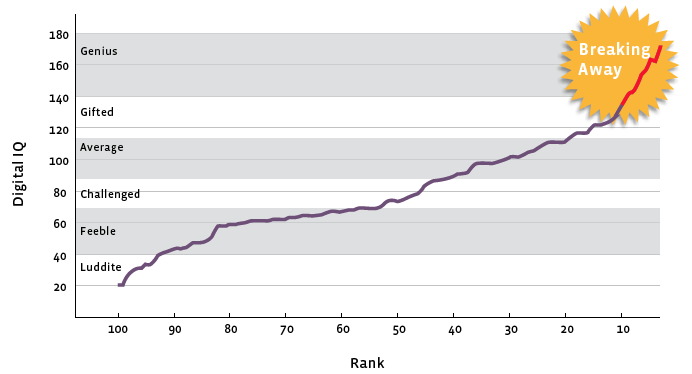

Prestige brands with the highest Digital IQ scores are breaking away from the pack. In mature markets, measurements of digital competence show prestige brands tightly bunched together—leaders do not achieve significant separation from brands with average Digital IQ scores. But in China, digital Geniuses are not just in the lead—they’re winning big. For example, the five brands in the Genius category boast a mean Digital IQ more than 25 points higher than that of the next five brands. In comparison, brands ranked six through ten show a mean difference of only 13.2 points compared to those ranked eleven through fifteen. As shown in Figure 3, digital leaders start “breaking away” at an inflection point around Digital IQ 120. Brands at the bottom end of the ranking demonstrate a similar but opposite effect—they lag significantly behind brands with average Digital IQ scores.

Figure 3: Digital Genuises are Breaking Away

Fifty-nine percent of the luxury brands in the study of Digital IQ in China were also measured in a separate study of the Digital IQ of luxury brands in the U.S., dated September 2009. Brands measured in both indices demonstrated a correlation of 0.58 between their Chinese Digital IQ and their U.S. Digital IQ, suggesting that digital competence in one market can be leveraged in another. Beauty brands Lancôme, Clarins, and Estée Lauder show the greatest positive disparity between Chinese and U.S. Digital IQ. This suggests their recognition of the opportunity to build brands in China through digital media. Meanwhile, champagne brands Veuve Clicquot, Moët & Chandon, and Dom Pérignon demonstrate the largest negative disparity—none of them support a Chinese language version of their brand site. Negative disparities may speak to inability or carelessness when translating digital competence from West to East.

Most prestige brands earning high Digital IQ scores in China share at least two attributes: local relevance and availability across a broad range of media.

Local relevance stems partly from familiarity with Chinese sites like Baidu, Kaixin, and Youku, which can be loosely compared to Google, Facebook, and YouTube, respectively. But brands doing business in China must recognize that for Western sites and their Chinese counterparts, different strategies are required; simply translating site content is often ineffective.

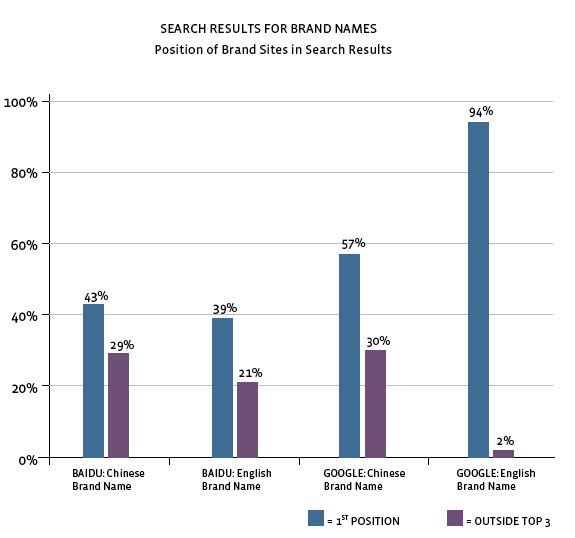

While homegrown search engine Baidu boasts 62 percent market share in China3, only 39 percent of measured prestige brands come up first in its organic results when searching by English brand name. Meanwhile, 94 percent of brand sites came up first on Google.cn (prior to its departure from China) when using English names. When searching with Chinese names, approximately 30 percent of brand sites are not among the top three search results on either search engine. This indicates the difficulty of brand name translation for many multinational brands. These numbers suggest that many brands approach search visibility with a Google-centric mentality that fails to recognize the Baidu algorithm and other local nuances.

One way brands can enhance SEO is by creating more opportunities for consumer interaction through a combination of social network sites (SNS), microsites, bulletin-board systems (BBS) and e-commerce and mobile websites.

Although many prestige brands are eliciting thousands of user-generated comments, video uploads, blog posts, and photos on popular SNS like RenRen, Qzone, Kaixin001, and YouKu, very few are interacting directly with consumers on these sites. As consumers are increasingly expecting brand communications to be interactive, rather than one-way broadcasts, digitally savvy brands that are beginning to engage directly with users on SNS platforms stand to gain an edge. Mercedes-Benz, Audi, and BMW host contests on RenRen, while Dior has a page on Qzone. Digital Genius Lancôme boasts an official group on Kaixin001 with more than 250,000 members. Johnnie Walker also hosts a group on the platform.

Four of the brands in the study have invested in branded online communities. Digital Genius Lancôme launched an online community called Rose Beauty in 2006 and has four million subscribers. Estée Lauder and Clarins also host branded beauty communities. BMW has created a community for the estimated 150,000 BMW drivers in China through its MyBMWClub.cn site. Meanwhile, Audi, Mercedes-Benz, and Porsche have created simple-interface BBS to help facilitate discussions with avid fans. Although the appropriateness of microsites as a means of online consumer interaction is debatable, efforts from these brands demonstrate a heightened commitment to the Chinese marketplace.

On average, brands that embrace e-commerce boast Digital IQ scores 50 points higher than brands that do not sell online. The size of the e-commerce market in China may have quadrupled from 2006 to 20094, but only ten of the 100 prestige brands in the study offer online transactions. The Beauty & Skincare category leads with six of 13 brands selling online. Many prestige brands opt against e-commerce for fear it will reflect poorly on the brand’s premium status and diminish control over the sales experience. However, as fashion brand and China first-mover Ports 1961 is the only foreign brand outside of the Beauty category to sell online, making e-commerce available would be a clear point of differentiation within many prestige categories.

In addition to website enhancements, SEO, and SNS, it is imperative for luxury brands to develop a mobile strategy. There are an estimated 745 million mobile phone subscribers in China5, and more than one quarter of mobile users access the internet through their phones6. China has considerably lower in-home internet penetration than most developed nations, and many Chinese consumers move directly from no internet to mobile internet. Yet, only 42 percent of the measured brands have mobile-enabled sites. Hong Kong brand Shanghai Tang is one of the first luxury brands to incorporate a Chinese language iPhone application.

While at least rudimentary digital competence is essential for prestige brands operating in China, specific digital strategies should be customized based on a brand’s vision and personality, opportunities and positioning, rather than a “check box” approach. As with other brand communication and media, digital strategy should be informed by comprehensive and up-to-date market research, strengthened by sound analysis and concrete brand positioning, and executed with distinctive and compelling creative work. Ultimately, brands with a deeper understanding of their Chinese customers, local competition, and familiarity with their own reputation and strengths will fare better, both online and off.

[1] “L2 Digital IQ Index: China”. Scott Galloway &, Doug Guthrie, June 16, 2009.

[2] “100 Best Global Brands”, BusinessWeek, September 2009

[3] “China Online”, eMarketer, December 2010 iResearch, February 2009

[4] iResearch, February 2009

[5] Ministry of the Information Industry, People’s Republic of China, August 2009

[6] “Global Device Insight Report”, Nielsen, October 2009

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.