In 1949, a man named Frank MacNamara was dining in a restaurant in New York City when he realized he was without his wallet. With no way to pay for his dinner, the idea of paying with credit was born on that fateful evening through the first-ever consumer-facing credit card company called the Diner’s Club. Little did Frank know how widespread the credit card would become in our modern day.

The sign-now, pay-later way of life has come a long way since the 1950s. In 2016, digital payments in the US have eclipsed cash payments for the first time, and the physical and digital world of payment are converging. In China, over 100 million new credit cards were issued by the 11 listed commercial banks in 2016 alone. In the US, 72% of consumers were found to have at least a single credit card by 2014. As an original member of the Diner’s Club predicted that “The day will come when the plastic card will make money obsolete,” we are now at the edge of a new frontier where credit cards have become less and less about the plastic rectangle itself.

Credit cards are multi-dimensional, off-line platforms, connecting both the diner with the restaurant, and the holder of the card with any other diners who might share the emotional preferences (or premium credit line) represented by the card. Platforms bridge the space between entities, not just via online service centers, but through physical objects that enable a transaction. Credit cards comprise their own category of platform brands with a unique set of considerations.

Today, we see credit card issuers facing 2 major challenges:

In an impending future where a plastic rectangle may no longer be the predominant medium for paying with credit, we believe semiotics provides an answer to how credit card companies can develop new directions for innovating around the plastic swipe experience.

To understand how credit card companies are currently addressing the needs and desires of their customers, we rely on a semiotic approach to guide us through evolving credit card communication codes and cultural signifiers in both China and the US.

The role of the credit card in different countries is largely influenced by the prevailing cultural contexts. For example, in countries such as China, saving is traditionally lauded and borrowing is perceived to be shameful. As the saying goes, “food in hand, no panic in heart” (手中有粮,心里不慌), which also encapsulates the Chinese mentality around money.

However, Chinese people’s comfort with borrowing is increasing with an increase in personal wealth. With more and more options offering speed, convenience and efficiency, credit card penetration is projected to grow from 16% of the population in 2014 to 44% by 2025. Even so, caution has not been entirely thrown to the wind as a close eye is kept on China’s doubling household debt figure in proportion to its GDP over the last decade, climbing as high as 40.7%.

China now is a spending power with a saving culture at its root. Understandably, credit card issuers in China focus on the functional benefits, or in other words, practical interests when communicating their products and services. Here are 3 examples representing the communication of credit card companies in China today:

Events that dot our histories also influence the overall sentiment around credit cards. Still recovering from the collective memory of the 2008 mortgage crisis and subsequent recession, the US has also been grappling with a host of security issues. Between breaches of major stores such as Target and Chipotle appearing as a frequent headline, and cases like the more recent 2017 Wells Fargo scandal, consumer confidence in financial institutions continues to unravel. The shockwaves emanating from these events point toward an all-time low in the level of trust for banks.

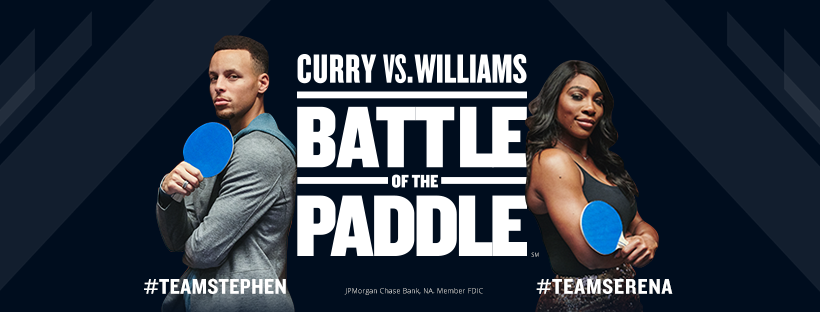

In the case for the US, bridging the trust gap with customers may require companies to go beyond functional benefits of credit cards to conveying a level of assurance through emotionally resonant communication. Here are 3 examples representing the communication of credit card issuers in the US today:

With these expressions laid side by side, we see a stark contrast between the communication approach in China versus US. While communication in China focuses heavily on the functional and economic benefits of credit card use (convenience & rewards), we see the U.S. emphasizing the accompanying emotional benefits (taking control & being adventurous) that happen along the journey facilitated by a credit card.

With these communication themes in mind, we next look to the physical credit cards themselves to discover what they reveal about cultural values that have evolved over time.

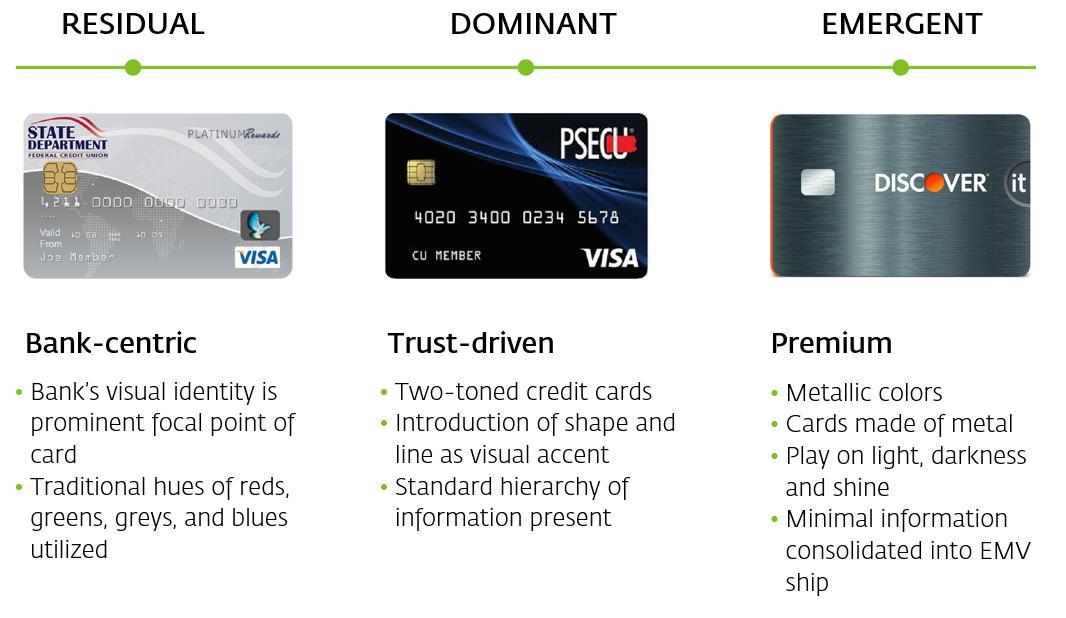

Since the 1980s, credit cards in the US have undergone shifts both subtle and substantial that have changed the credit card experience. Take for example the Capital One Venture card. The card has metamorphosed into a sleeker, simpler version of its former self:

Similar riffs on texture, color, and material have occurred across several premium credit cards such as the Chase Sapphire Reserve, Discover it, and Chase Ink cards to embrace codes of exclusivity. In tandem with this visual progression, credit card brands have begun to rise above the bank brand. As names such as Venture, Sapphire Reserve, and Ink become more prominent, bank brands themselves have retreated into the background to act more as endorsements behind the credit card.

Moreover, credit cards are shifting from leveraging strong banking codes, moving more into trust and security similar to financial services, and finally into codes of premiumness and exclusivity.

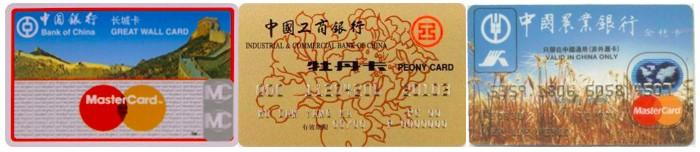

Across the pond in China, we have come a long way from the very first credit card issued by the Bank of China in 1986 and dubbed the “Great Wall Card” to signify grandeur, status, and longevity. Other major banks soon followed suit. ICBC launched its “Peony Card” in 1989. As an auspicious signifier of wealth, the peony has long been believed to be the unofficial national flower and praised as the “King of All Flowers”. In 1991, Agricultural Bank of China started to issue the “Golden Wheat Card”, using “wheat” to correspond with the business of the bank and signify prosperity and lasting peace.

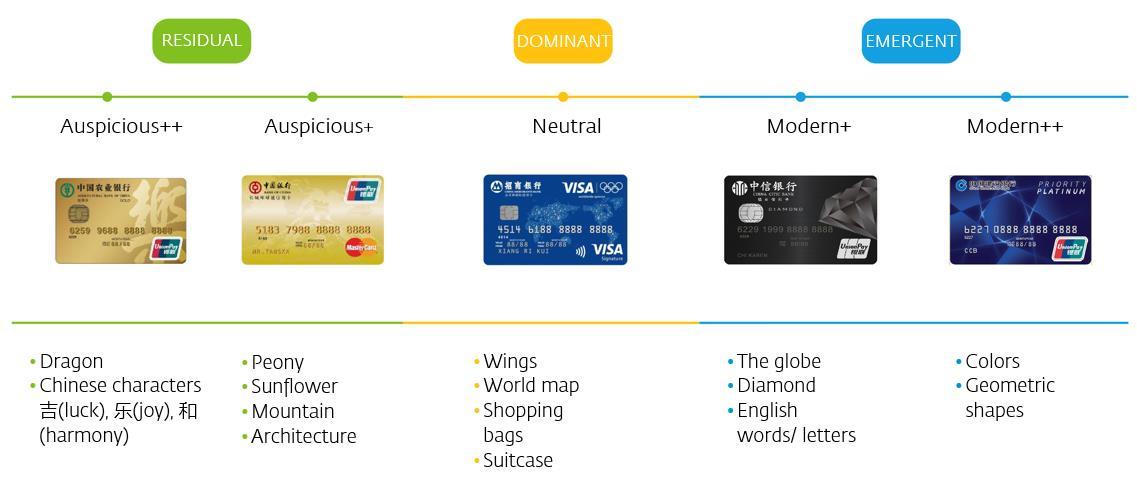

Credit cards in China were born with auspicious signifiers, which are still largely popular, but as customer understanding around money spending becomes increasingly modernized with their wealth, more signifiers are emerging to complement and even disrupt the traditional concepts around auspiciousness.

In the most auspicious group, we find cultural signifiers that have carried over for hundreds and thousands of years – with dragons signifying power & status, and single characters conveying luck, joy or harmony. There are also signifiers derived from daily landscapes that are less auspicious but aimed at more attainable ideals such as the peony, sunflower (prosperity), mountain (stability), and architecture (grandeur). Travel-related signifiers such as the wings, world map, shopping bags and suitcase fall in the middle to indicate yet more tangible things that are be attained through the use of the card itself. And finally, while the modern signifiers also draw inspiration from things that we see and touch – such as a globe, diamond, English words or letters – the most modern signifiers take more of an abstract turn to only include colors and geometric shapes that are more open for interpretation.

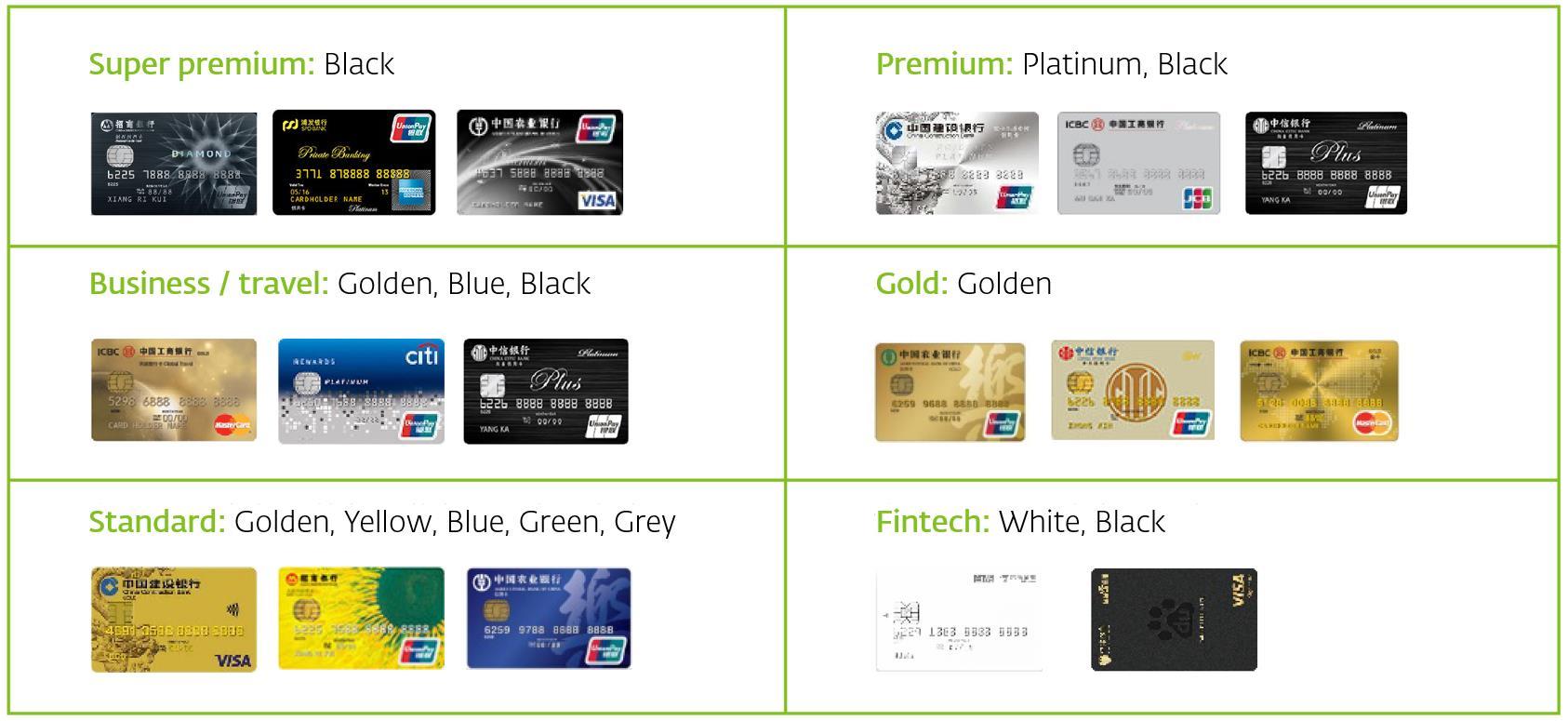

We see hierarchy also signified through color. It used to be that standard and gold colors were prestigious enough to signify authority, wealth and perpetuity. But as more and more people in China surpass the title of millionaire, gold alone is no longer premium enough. This creates room to grow above and beyond the current ceiling of the credit card hierarchy. From “gold”, we go a couple notches up to “premium” which mainly uses platinum colors to indicate higher value than gold, and “super premium” conveyed exclusively through black to represent elegance and serenity – attributes that are prized by individuals with the highest net worth.

As more digital payment services and even digital credit line services emerge to disrupt traditional payment methods, it is clear that our world is headed toward a post-credit card future. As Visa’s Vice President of Innovation so aptly put it, “The magic of Uber and Amazon is that they made payment kind of disappear”. In the same vein, a 2017 research study conducted by Labbrand found that 85.6% of Chinese Millennials use mobile payment for offline purchases. Beyond that, Chinese payment platform Alipay has reported over 100 million users signed up for its virtual credit line service Huabei (or Ant Check Later). Among those, 37.4% of 27 year-olds and younger users set up lines of credit as their primary payment method.

It begs the question – what comes next for credit cards in the US & China? And how does a semiotic approach help credit cards with the challenge posed by the digital payment alternatives?

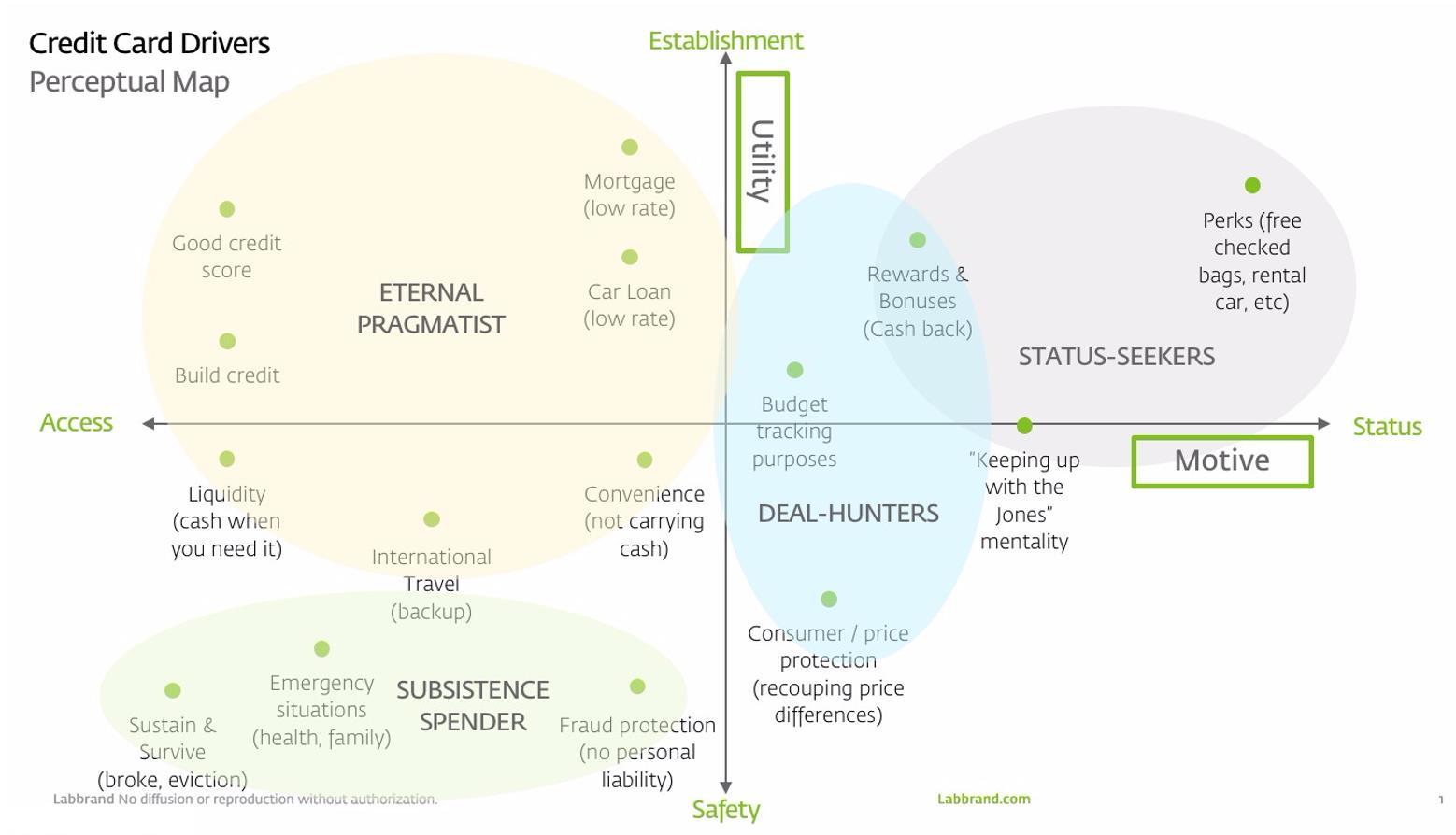

To answer that, we must be able to identify what digital payment alternatives offer that credit cards do not, and vice versa. Having foresight into what comes will require a firm understanding of the emotional territory that credit cards occupy within the manifest and latent needs of Chinese and US customers. The following perceptual map digs deeper into the drivers associated with credit usage and how they measure up to themes of security and wealth:

The ritual of taking a card out of the wallet, swiping, and signing on paper has been around for decades, but the intrinsic drivers associated with the ritual goes deeper than a one-and-done transaction. While digital payments offer convenience and security, they have not yet fully entered into the realm of sensory experience or VIP treatment as the physical credit card has commanded for years. In a post-plastic future, credit card providers may find their sweet spot by further tapping into the senses and striving for greater relevance to habits that facilitate a sense of status or prestige.

In sum, we’ve distilled our learnings down to 3 key opportunity areas informed by semiotic insight:

1. Emphasis on the tactile in a digital world. What credit cards offer that the digital payment world has not yet figured out is the fulfillment of our hedonistic drivers as human beings. White-glove experiences that reinforce the status of individuals while drawing on the senses through the tactile will maintain a strong allure among status seekers and VIP members alike.

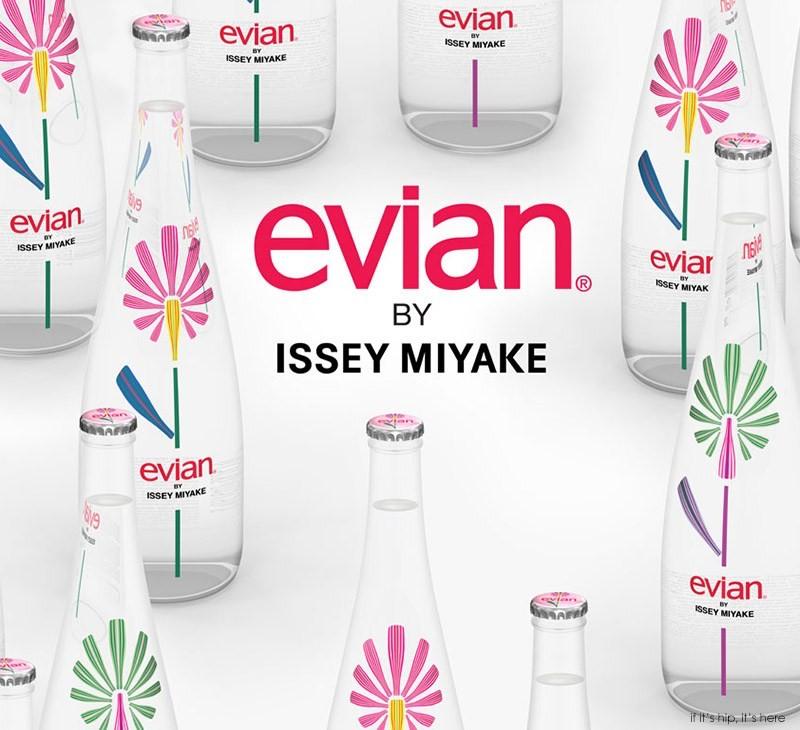

2. Fashion forward through variation and personalization. Reimagining the role of credit cards as an expression of a fashion statement is one way to support users in their goal of building up their own personal brands. Whether it be through collaboration with fashion designers on patterns and materials, or providing pathways to personalization, there is still much room to explore different variations of the credit card.

3. Untapped potential of disruptive codes and formats. While exclusivity and premium codes are commonly enlisted upon among the status quo of credit cards today, codes that communicate a sense of calmness or zen are a source of untapped potential. Just as Muji has mastered the minimalistic expression, we see an opportunity for credit cards to vary their visual codes to convey ease, balance, and a peace of mind. Never-seen-before formats, such as key chains, rings, and stickers, will also continue to transform the plastic swipe experience as we know it.

Looking ahead, the opportunity for credit card companies will be to stay relevant and responsive to the evolving trust dynamics and emerging connectivity. Cashing in on the opportunity will require a semiotic eye for emerging codes and sensory experiences in order to bring meaningful innovation to the future of payments.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.