Even today as many brands move China to the center of their worldwide strategy, obtaining meaningful customer insights in the Middle Kingdom is still a challenge. The country’s size, its diversity, the fast pace of change and the uniqueness of local consumption habits are only some of the many obstacles encountered by brands who seek to get a clearer picture of their market.

Thankfully today, a new force is coming to brands’ rescue: the ongoing digital revolution. Chinese consumers, especially (but not only) in younger age groups, are integrating the web and the mobile web into every aspect of their daily lives and consumption habits to a degree that has no equivalent. The country’s 538 million netizens and 388 million mobile netizens spend over 3.6 hours online per day, 80% of them deem the internet to be absolutely essential in the purchasing process and 80% rate products online. China has the biggest and most active social media population in the world. 56% of microblog users follow at least one brand, 60% admit having already made a purchase because of a social media campaign and 70% of Chinese youths regularly share information about their purchases on social networks (China youthology). Furthermore, a recent report from China Internet Network Information Center (CNNIC) stated that for the first time, the number of Chinese mobile netizens now surpasses that of desktop netizens (388 million vs. 380 million). The internet is seen as the most engaging medium of brand communication and is the most trusted source of brand information. All in all: Chinese consumers are online and are talking about and interacting with brands on a colossal scale. By so doing they are leaving a trail of data that can be leveraged by brands.

This article will take a look at online spaces in China and how digital research can be conducted as part of a brand’s larger consumer insights program.

China’s online spaces have similarities with those in other countries around the globe, however there are important differences that should be noted. For one, different social media platforms are used in China than elsewhere- for example Facebook, Twitter, Youtube and other sites are not accessible here but have local equivalents. However, Chinese platforms such as Kaixin, Weibo, Youku, etc. are not exact replicas of SNSs in other countries; rather they possess their own unique features that need to be understood by brands. Secondly, forums and BBS conversations play an important role in China. These online spaces of discussion are the primary catalyzers of brand word of mouth. Brands need to be aware of the local features of China’s online spaces to prevent irrelevant strategies used in other markets from being applied here.

Arguably more than in any other market, the role of influencers is key in spreading the brand message in China. Through online data and tools, brands can identify influencers for the purposes of research as well as other uses such as developing multi-layered communication approaches.

Most brands recognize the importance of influencers, and some have incorporated this into their digital research initiatives. For example, Labbrand collaborated with a youth research agency called The Sound on a project for Pepsi, where the goal was to understand the top 9% of young Chinese bloggers who discuss culture, spread ideas, and influence others online in order to support Pepsi’s marketing and positioning strategy in the Chinese market. Labbrand contacted 28 active bloggers from Beijing, Shanghai, Chengdu and Shenyang. For several days, they logged onto an online forum to answer specific questions about their identities, lifestyles, media habits, sources of inspiration and influences. Two moderators actively facilitated their discussions. As this study was very culturally influenced, Labbrand also researched traditional Chinese values in order to be able to compare them to modern ones. The research served to orient Pepsi on how these prominent netizens were themselves influenced and motivated. Specifically, the challenges facing young adults who struggle with social pressure and changing cultural norms were identified. Using these results, Pepsi was able to better choose their marketing and positioning strategies and cater their methods of communication to these influential segments of the youth population.

Since netizens often organize themselves into groups on digital platforms, these communities are also spaces that can be analyzed, potentially contributing to consumer segmentation exercises and a variety of other objectives. In addition to understanding segmentation of consumers online into natural interest groups, geographic characteristics available in web traffic reports can be used to identify regional discrepancies in consumer behavior and brand popularity.

Digital research can take a variety of different forms. Sometimes simple online desktop research is conducted as a preliminary step in a larger research project to facilitate a deep dive into the topic at hand. Depending on the research objectives of a specific project, quantitative or qualitative research can be conducted on online data. For quantitative digital research, crawlers, software, and other tools are used to extract data, which is then structured and analyzed using methods similar to traditional quanti research. (It should be noted that with the technical complexities of a character-based language, sometimes tools that are effective on alphabet-based texts run into glitches on Chinese platforms and must be complimented with manual searches/textual analysis). For qualitative approaches, similar principles govern digital and traditional research methods. The steps below can guide the digital research process:

Step 1: Research Design According to Best Practices

Even though digital research is a relatively new approach, the best practices that apply to conventional research design should still be carefully considered. Digital research should not be conducted simply for its own sake or because it is trendy- it needs to contribute to the prevailing business objectives.

Step 2: Use Tools to Extract or Identify Key Data

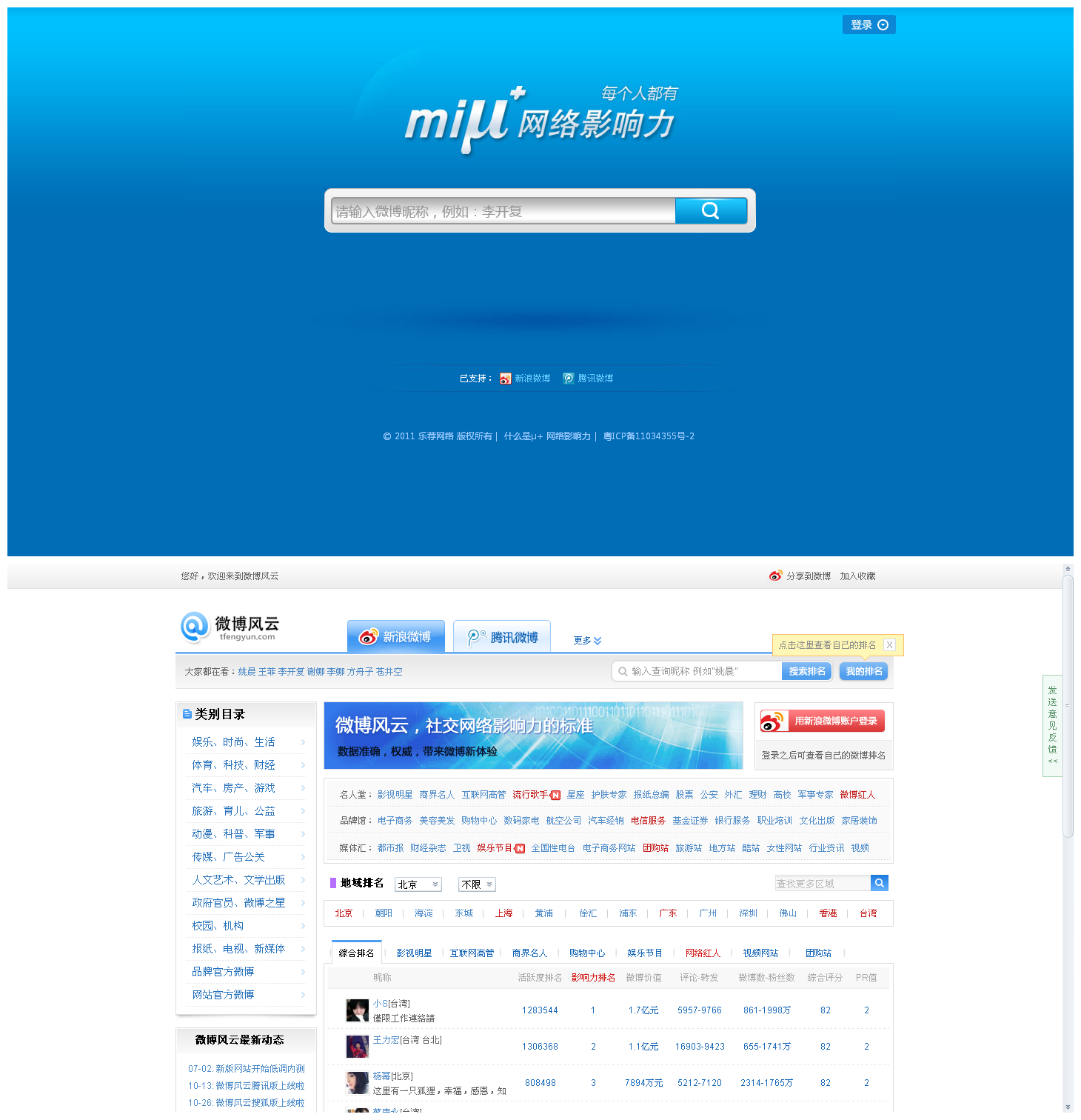

Since the body of online data is so vast, it is necessary to use tools to extract or identify the data relevant to the specific research study at hand. It should be noted that some local SNS sites have screened web crawlers. The new enterprise version of SinaWeibo now includes sophisticated integrated analysis tools and is more open to 3rd party applications through the SinaWeibo API (Application Programming Interface), thus offering more possibilities for data collection and text analysis via Weibo. There are also tools available to identify the most popular Weibo sites, such as Miujia.com and tfengyun.com. The first one gives a score to Weibo accounts in terms of their influence, and the second is a ranking of the most influence of Weibo accounts across different industries.

Step 3: Analysis and Reporting

Methods for analysis and reporting on digital data are similar to other traditional forms of research. However, the advantages as well as limitations of the research methodology would need to be made clear for those that are using the findings. As always, the strategic implications of the findings should be outlined, rather than simply stating research results.

While the field of digital research is an emerging one, there is already much experience and knowledge that has been gained by brands, research agencies, brand consultancies, and academia alike. If they haven’t done so already, brands need to start utilizing digital research as part of their larger consumer insights program, even if it is on a small scale at first, and to become familiar with current best practices, as it is likely to continue take on increased importance in the future. Furthermore, digital research that is conducted with the intention of informing digital strategy holds much promise. While many agencies are poised ready to help brands launch websites, social media pages, and campaigns, it is still rare that the approach to digital is grounded in insights and considered strategically. We recommend that brands include research, including digital insights, in their overall brand development scheme- thereby informing brand strategy, brand identity development, and ultimately brand implementation on a tactical level.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.