As the living standard of the Chinese people rises with greater economic development, domestic and international corporations are eager to offer consumers more purchasing choices. These choices are not only created by new products but also by different brands with distinct attributes and images that appeal to various segments of the population. Brands signify qualities such as high quality or fashionable style, and they also convey affiliation to a certain social class or group. As a result, brands can be sold at premium prices even when they are produced at the same cost as non-branded alternatives. Effective branding strategies for Chinese low-priced consumer goods play a crucial role in navigating this dynamic market landscape.

In a developing country like China, a substantial portion of the market lacks significant purchasing power. With an annual per capita urban resident consumption expenditure of only 8696 CNY in 2006, the vast majority of the Chinese population may not become regular customers of premium brands. However, companies that strategically focus on developing robust branding strategies for low-priced consumer goods stand to gain a more significant market share among budget-conscious Chinese consumers.

The sheer size of the consumer goods market in China has been an incentive for intense competition in almost every industry. Small firms can inexpensively enter the market due to the lack of IPR enforcements, use their capabilities to imitate existing products, and successfully overcome technical barriers. At the same time, effective use of mass production allows them to lower the production cost and retail prices. They can further undercut their competitors by reducing profit margins, making up for lost revenue by selling large quantities of the same products.

Such a saturated and established consumer goods market strongly discourages investment in creating strong low-end brands and improving their market share. After all, in a market long dependent on price competition to attract consumers, generating brand loyalty even for well-known and well-established brands seems to be difficult. Many firms believe it is better to cut branding costs in order to have a price advantage. In this article, however, we will argue that for low-priced products the brand remains the distinctive factor on which Chinese consumer base their purchasing decisions.

In a market notorious for mass-producing goods with limited attention to design, material quality, or production processes, the brand serves as a crucial quality marker. In the low-end market, where similar goods may have a small price difference, consumers often opt for products from reputable brands. The perception is that well-known brands are of higher quality, as their popularity translates mentally into “more people buy it, so it must be better.” Effective branding strategies play a pivotal role in establishing this association and influencing consumer choices.

Indeed, consumer purchasing is affected by strong brands as they are seen as a mark of product safety. Studies show that product-related factors such as price and brand name, in addition to store name, promotion channels, source credibility, country of origin, nature of product testing authority, and warranty, all significantly affect the final choice the consumer makes with regards to similar product offerings. Therefore, by carefully manipulating these variables when formulating brand strategy managers can attract the large and growing market of safety-conscious consumers and gain a significant competitive edge .

In addition to product quality and safety, the brand can also be differentiated through benefits above and beyond the products’ functional attributes. In other words, the brand itself becomes a tool of product differentiation and therefore a competitive advantage. Even when the branded product is essentially the same as the non-branded one, the brand name gives it added qualities.

Chinese consumers tend to have a short list of preferred brands for the products they purchase regularly and do not easily stray from it when making purchases. Naturally, and especially in light of the current economic crisis, consumers of low-priced products are price sensitive and thus not always loyal to their preferred brands (in-store deals and promotions can divert purchase from preferred brand). Still, on average Chinese consumers are willing to pay a premium of about 2.5 percent for a branded product they purchase regularly. Thus brand building and development in this segment of the market is and will remain essential .

Navigating the challenges of the low-end market, characterized by intense price competition, poses a significant hurdle for firms aspiring to build profitable and sustainable brands. This is further complicated by the prevalence of piracy and copyright infringement in the Chinese market. To cut costs, many low-end firms eschew investing in original branding, opting instead to leverage brand names and visual identities closely resembling well-known counterparts to promote their own products. Crafting effective branding strategies becomes imperative in this landscape to establish and protect brand value.

For instance Whitecat (白猫), the historical domestic brand of detergent, has reason to be annoyed by the existence of Dailycat “日猫” that has copied not only the brand name but also the logo and packaging design. Many consumers purchase Dailycat by mistake as they believe that what they’re getting is the famous brand Whitecat or a sub-brand – slightly cheaper – of its portfolio.

Moreover, in order to overcome competition from cheap pirated goods, low-end firms have a tendency to become producers of copycat, if not pirated, goods. There is a strong incentive to give up branding investment and focus on price competition for short-term profits in the low-priced consumer goods market. In other words, strong commitment and persistent brand investments that are more for long term revenues than for short term profits are necessary to truly create strong low-priced brands. The problem is that many firms simply do not have the financial capability to continue such investments over long periods of time.

CECT, a prominent player in the domestic cell phone market, serves as a compelling example of dynamic branding strategies. Initially, CECT entered the competitive Chinese cell phone market with a focus on selling branded low-cost phones. However, driven by the need to maintain competitiveness and expand its market share, CECT strategically pivoted away from traditional branding. The company transitioned to producing and selling copycat mobiles, emulating popular brands like Nokia, Samsung, and Motorola, often at significantly reduced prices. Notably, some of these models were not even branded with “CECT.” This strategic shift highlights how CECT successfully navigated the market dynamics, showcasing the adaptability and profitability of innovative branding approaches in the fast-paced realm of consumer electronics.

Even though the aforementioned challenges may seem insurmountable, there are strategies that have proved successful in building profitable low-end market brands to attract a large share of price conscious consumers.

1. First Go High, Then Go Low

Firstly, and especially in the case of well-established firms, the brand can be introduced in the mid- to high-range markets before starting to target the low-end market. A strong reputation of high quality in mid-to-high end products can give the firm a sustainable competitive advantage when the same brand is introduced to the low-end market. On the one hand a sound reputation will allow the firm to benefit from economies of scale in marketing and branding. On the other hand, low-end consumers can be easily attracted by the brand as this is perceived as “high status” since it is widespread also among mid-to high end consumers. At that point, the brand can defeat competitors both on price and perceived quality.

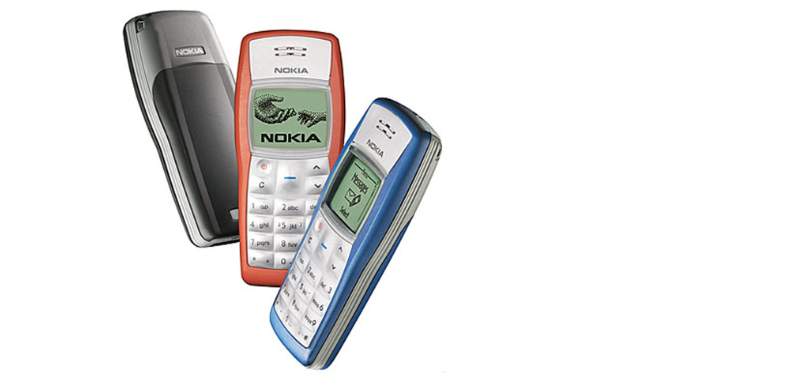

For instance Nokia, no 1 in China in the mobile phone market, first captured a large segment of the high-end urban market before starting to sell cheap durable cell phones to the Chinese rural market. Nokia 1100, the first Nokia low-end phone in China, was launched in 2003 when color screens already prevailed in the overcrowded Chinese mobile phone market. The phone featured a black and white screen but it nevertheless became one of Nokia largest cash cows. Chinese farmers’ craze for Nokia 1100 largely stemmed from its well-known attribute of high quality matched with customized features – the mobile was dust-proof and had an in-built flashlight, both very useful functional characteristics if living in rural China. The customized attributes were developed by the famous Finnish mobile brand after having conducted extensive market research to understand the specific needs of the Chinese rural market.

Naturally, as in the case of Nokia, in order to successfully build a strong low-priced brand, the firm must also understand how to satisfy the needs of the target consumer base.

2. Niche brand strategy

Secondly, firms trying to build strong low-end market brands in China will be more successful if they target consumers with unique and specific needs in this market bracket rather than producing products that are similar to the other non-branded, low priced ones.

For instance, Chinese candy Yake V9 secured the market for candy-lovers with strong concerns for nutrition by specifically advertising the Vitamin C content.

Another example is Asus, the Chinese manufacturer of cheap computers and laptops, who has developed a low-priced, small and well-designed laptop that successfully targets budget-concerned consumers who wish to have a sleek and light PC to carry around without having to spend a significant amount of money to get it.

Similarly, Cortry Cosmetics, a successful low-priced domestic brand, targets its products to female consumers who appreciate the curative powers of Chinese traditional medicine. In fact, the brand uses the concept of “汉方养眼” [hanfangyangyan] to distinguish itself from competitors, which expresses the idea of making eye care products accordingly to traditional Chinese medicine practices – supposedly handed down since the Han Dynasty.

3. Provide a Brand Experience

Thirdly, in order to minimize branding expenses to remain competitive in the market for low-priced goods, brand managers can exploit cheaper and more innovative alternatives to traditional brand building and marketing. Public displays, media coverage, and word-of-mouth are all low cost ways to increase the visibility of a brand in the marketplace.

3M security glass outdoor advertisement is a good example of such tactics. Even though they are not the highest priced solution in the market, to show how strong the branded security glass really is, the firm set up a glass box filled with money in urban central locations. The “ad” drew not only the attention of passers-by but also of media and the general public – media reports worked more effectively than traditional advertisement and were totally free!

Inexpensively expanding its market share, Sinoway Herb, a Chinese cosmetic brand specializing in natural herbal personal care products, strategically utilized the Internet, with a primary focus on weyii.com, a prominent online cosmetic community. Leveraging this platform, the brand distributed free samples, gathered user information, received valuable feedback, and engaged with its target demographic of young girls. Through these virtual brand experiences, Sinoway Herb successfully reached over two hundred thousand people, showcasing the effectiveness of digital strategies in enhancing brand presence.

Absolutely. China’s budget-conscious consumers represent the majority of the domestic market. Chinese shoppers tend to stick with known and preferred brands rather than switching to unfamiliar ones. In a country where the cheapest price tag often indicates low, if not dangerous, quality standards, consumers understandably fear that the wrong product choice could lead to unpleasant consequences, especially when it comes to food or personal care products. Successful branding strategies can address these concerns, building trust and loyalty among Chinese consumers.

Achieving a successful low-priced brand entails establishing robust brand differentiation, presenting a substantial barrier for copycat brands. This approach prompts local consumers to identify the brand for its perceived higher quality or adeptness in meeting their needs, fostering a substantial consumer base willing to pay a nominal brand premium. As a result, companies specializing in low-priced consumer goods can expand their market share and enhance profitability in a sustainable manner through effective branding strategies.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.