In the dynamic landscape of global markets, the significance of market and consumer research has undergone substantial changes in recent years. This transformation has not been without its challenges, giving rise to debates on crucial aspects such as qualitative versus quantitative approaches, the shift from offline to online methodologies, and the transition from presenting mere facts to providing actionable insights. Additionally, the focus on emerging consumer groups in developing nations, particularly in Asian markets, and the distinctive characteristics of Generation Y, has intensified, drawing increased attention from both brands and researchers. Engaging in effective brand research becomes pivotal in navigating this evolving terrain.

In today’s globalized world, brand research projects increasingly span several countries. As such, it is important for brands and researchers to understand regional particularities at the risk of applying an approach that proves locally ineffective. In this article, we will discuss several key considerations for conducting brand research in China, including online research, moderation, ethnography, fieldwork locations, and cultural and semiotic analysis.

For several years now online methodologies have been growing in popularity, but they are not necessarily making traditional research approaches obsolete. Rather, online and offline approaches are often used together for increased effectiveness.

In China, online consumer research holds much promise, but the approach needs to be carefully considered in light of the research objectives or business problems being addressed. Online methodologies should not be used only to minimize costs, but rather because they will improve the ability of the research to produce useful insights. In China, a huge volume of interaction takes place online every moment, through blogs and microblogs, ecommerce websites, social media, and more. Teenagers, university students, and young professionals are all heavy users of the internet, spending several hours online every day. Some individuals are better able to express themselves or feel more comfortable in an online setting than face to face. Furthermore, young netizens often have excellent written English abilities, so they may be able to interact with an English speaking moderator on these platforms (although it is highly recommended to conduct research in Mandarin whenever possible).

The benefits of online research are often not realized by a simple chatroom that mimics a focus group format. Rather, if a platform is set up for participants to use regularly for one week or longer, where they can post pictures and videos, share daily experiences and interact with other participants, deeper insights can be gained.

The moderator always has an important role to play in qualitative research; however, due to cultural characteristics such as the preference for politeness and modestly, the importance of face, and the use of indirect communication, the moderator in China plays a crucial role in helping consumers speak freely in the research setting thereby enabling the discovery of useful research findings. It is usually essential that the moderator be Chinese. This is not only because native fluency in the language is needed, but also because the participants will be more polite and try to give a good impression to a “foreign” moderator. Time for self-introductions and warming up exercises is needed, so that participants are able to get involved in the discussion and express themselves more freely in the focus group setting.

With new and exciting advances in research technologies, cutting-edge techniques can tend to overshadow tried and tested traditional methods. Ethnographic methods such as home visits are still very useful, allowing for a more accurate depiction of participants’ lives in their everyday environments. In China, where the society can be seen as both traditional and ultra-modern at the same time, researchers should not overlook ethnography as a viable research tool.

Although other techniques permit glimpses into the daily lives of individuals, for example when participants upload photos to an online platform, the participants are still choosing what to show and what to conceal from the researcher. When the researcher can visit the participant’s home, there are less things to hide, and a more candid version of their reality can be observed. Participants and their families can also be engaged with the data collection, for example by taking video footage of their daily lives. Sometimes what the researchers observe during the home visits compared to what is seen on video footage of the home can vary greatly.

Furthermore, for brands whose geographical reach extends to various parts of China, ethnography is important to understand variations between different regions as well as the differences between urban and rural settings.

The first picture was sent from participant to Labbrand and the second picture was collected by Labbrand during a home visit.

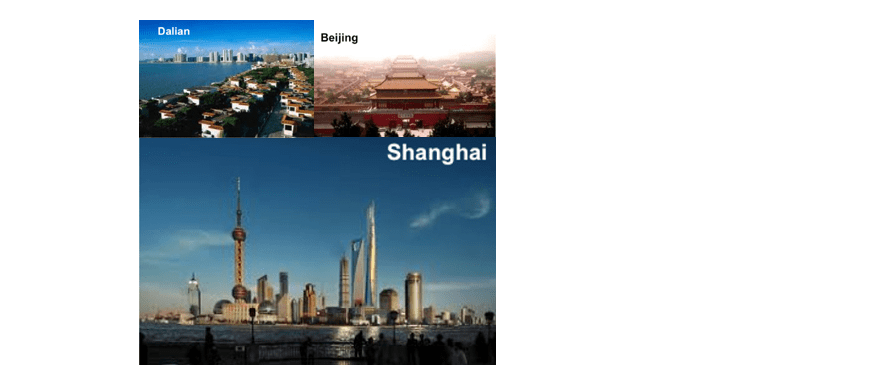

It is well known that China is a vast country with significant regional differences, but sometimes these particulars are not carefully considered when selecting cities for fieldwork. In general, cities in China are classified into various “Tiers” based on their level of development. For example Tier 1 cities include Shanghai, Beijing, Guangzhou, Dalin, and Shenzhen, Tier 2 includes Nanjing, Suzhou, Changsha, just to name a few. Furthermore, different cities have certain cultural and historical characteristics and varying demographics. For example, the city of Shenzhen has a disproportionately large population of young people when compared to other cities in China; in Guangzhou the wealthy tend to spend money on food and entertainment whereas in Beijing they display their affluence in the purchase and display of luxury goods. For brand research projects, the cities for fieldwork need to be chosen strategically, rather than selecting them haphazardly based on minimal information.

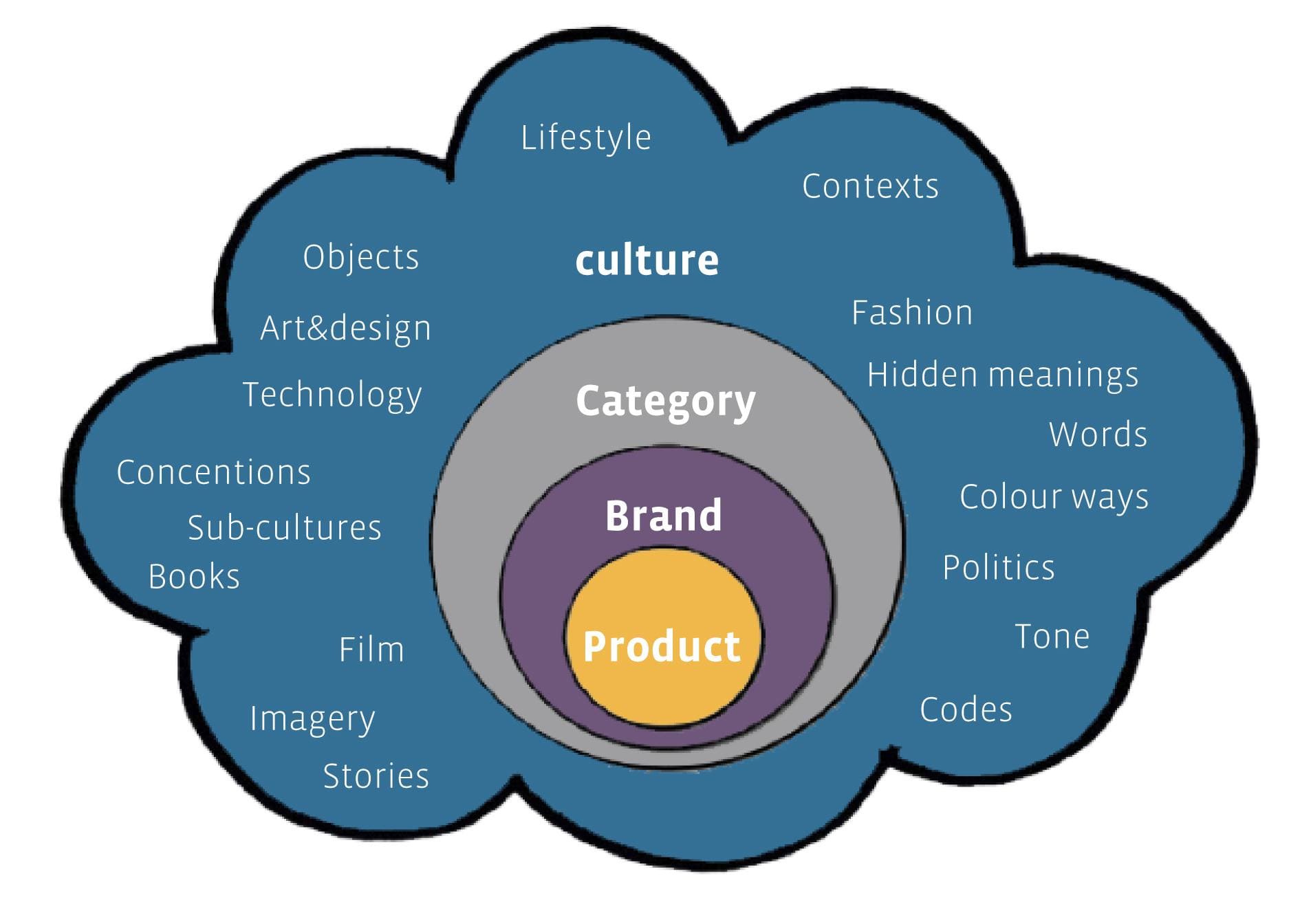

It is well known in that consumers have challenges expressing themselves clearly in research settings, and in particular when it comes to explaining complicated subjects. They will often be able to tell researchers that they don’t like something, that it seems old fashioned, etc., but this will not provide the deep insights needed for brand innovation. Due to its long history and rich traditional culture, as well as rapidly changing trends in lifestyle, fashion, technologies, and more, the cultural space in China is highly complex. As stated in the article Culture: Insight’s Third Space “Culture controls how brands work to produce meaning, and is one of the most fertile grounds for developing brand strategy and innovation.”

Culture can be studied by conducting cultural and semiotic analysis on materials relevant to a concept or category of interest to a brand. For example, an investigation of femininity or well being in Chinese culture and language may inform the brand positioning of a personal care brand. By decoding packaging design, advertising communications, viral videos, and other cultural data, a deep understanding of current expressions and meanings in product categories as well as emerging trends can be realized.

Cultural and semiotic analysis can be conducted as a standalone research project, or in combination with qualitative consumer research. These methodologies are now being called on regularly for multi-country as well as localized research, and have particular relevance in China.

Picture adapted from ESOMAR paper

Changes in the market and consumer research industry are happening on a global scale, as well as in Asian markets. Common examples include the blurring of quantitative and qualitative research boundaries, the incorporation of online research, and the use of non-consumer based methodologies such as semiotics. There are local particulars that remain unique in China that need to be taken into account by brands and researchers. Research projects that have been designed for other countries should not necessarily be applied without any adaptation. By carefully assessing trends and best practices in research in terms of how they apply to local markets such as China and fine tuning research project design as necessary, brands can ensure they collect data and generate insights that are relevant and meaningful to address the pressing business concerns they face.

DOWNLOAD REPORT

A Labbrand Group Company © 2005-2025 Labbrand All rights reserved

沪ICP备17001253号-3To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.