UPDATE (JUL 2016): Over the past few years, China’s own smartphone brands continue to thrive. Major players such as Xiaomi and Huawei dominate with outstanding quality, design and innovations. We have revisited the topic of the positioning of China’s smartphone brands in 2016. Click to read the updated article.

Step into the dynamic world of smartphones with a focus on Chinese smartphone brands. The 2013 Mobile World Congress in Barcelona marked a significant moment, showcasing cutting-edge technologies and putting Chinese brands like Huawei, ZTE, and ASUS in the spotlight. These brands from China have rapidly evolved into formidable players, securing spots in the Top 5 Global Smartphone Shipment by the end of 2012, as revealed in a recent report. Join us on a journey to explore how these Chinese smartphone brands strategically position themselves, carving a unique identity in the competitive global market.

China’s domestic smartphone brands has over 80% of the total market share by the end of 2012. Taking a look at Baidu’s most searched smartphone ranking, Chinese brands occupy half of the Top 20 spots.

The development of China’s smartphone industry has allowed a production chain to form and mature. Assembling modules and parts into smartphones has become a profitable business. This leads to the burst of budget smartphone brands. While many domestic brands still depend on low price to boost sales without properly managing brand equity, some have stepped up the game and are establishing solid brand image through differentiating brand positioning.

Diagram 1: Baidu’s Top Searched Smartphone Brands

We’ll analyze domestic brands with two frameworks: brand perceptual map and brand equity pillar.

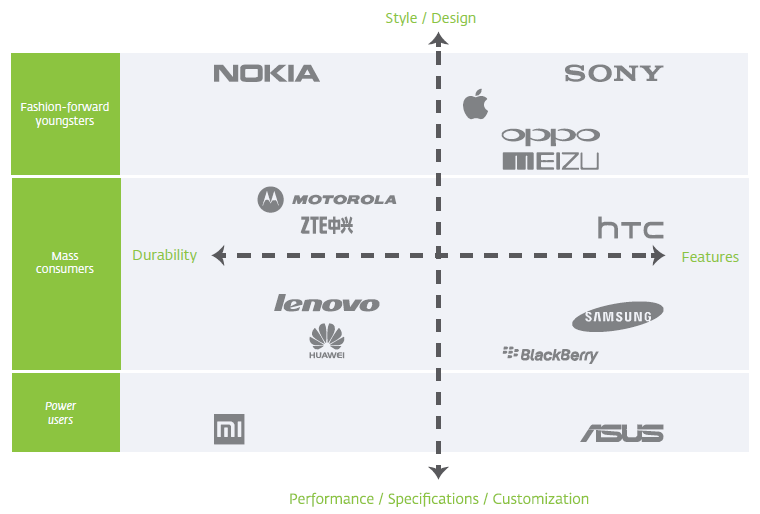

Diagram 2: Main positioning approaches of the leading smartphone brands in the Chinese market

Leading global smartphone brands offer distinguished hardware and interface design as well as strong features. On the other hand, Chinese brands mostly concentrate on building durable and high customization phones. They are targeted toward the mass consumers and power users while foreign brands mostly target fashion-forward youngsters. At the same time, we’re seeing brands such as OPPO and Meizu competing in the same category.

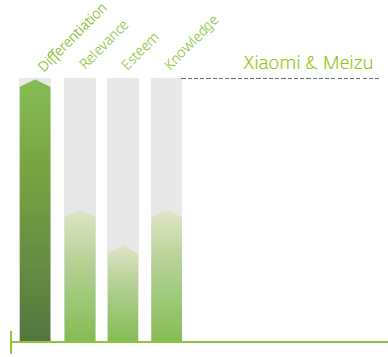

Xiaomi & Meizu: Optimizing user experience with customized UI for a differentiating positioning

One of the most popular Chinese brands in the market right now is Xiaomi. Xiaomi gained popularity by identifying a niche group of smartphone “power-users” or so-called “手机发烧友” [shǒu jī fā shāo yǒu] (literal translation means “cellphone fever friend”). These consumers are constantly tweaking their phones for richer features and the newest experience. Xiaomi phones are tailored for this particular group of consumers.

First announced in 2011, Xiaomi released its 2nd generation smartphone Mi2 last August.

This unique positioning is achieved by Xiaomi’s Android ROM MIUI, which is developed to better suit Chinese users’ habits and handle multiple tasks. Xiaomi Phones are equipped with excellent specifications to ensure the system performs smoothly. Xiaomi phones are exclusively sold online; this enabled the brand to sell at a highly affordable price for this specific group of audience who are most likely to be younger users. In December 2012, Xiaomi leveraged Sina Weibo’s new shopping platform to sell 50,000 Mi2 phones in 5 minutes and 14 seconds.

Former music player maker Meizu adopts a similar business model. Meizu also makes an impression by tailoring a self-developed Android ROM named Flyme. More of a coincidence, the first two generations of Meizu smartphones were announced in 2011 and 2012 as well.

Compared to Xiaomi’s who emphasizes on specifications and technical aspects, Meizu differentiates with a more feminine touch that reflects in Flyme’s simplistic LOMO-styled UI design. Naturally, we believe Meizu is more targeted towards young females who value a pleasant visual and a great user experience.

It is worth mentioning that these two brands have both created English websites and forums for online brand presence and generated discussions around their devices and ROMs. By developing English versions of the ROMs and opening to international users, Xiaomi and Meizu are taking their first step into the global market.

Although Xiaomi and Meizu both are highly differentiating and possess a strong personality, targeting a rather small group of consumers, these two brands overall are weaker in relevance. Plus, being relatively new to the smartphone market with room to improve in product quality, Xiaomi and Meizu still need to work on building higher brand esteem and knowledge.

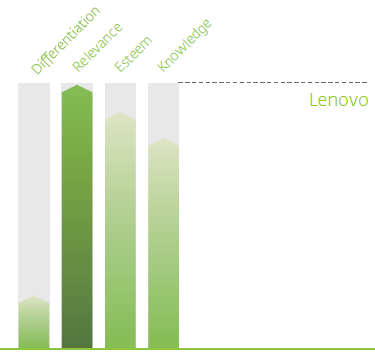

Lenovo: Seizing the growing markets

Although China’s smartphone market is flooded with global and domestic competition, there is still room to grow: according to Xinhua news, only 30%of total mobile users are using smartphones. The medium-low end market, where global leaders such as Apple and Samsung fall short, has great potential for brands to explore.

Lenovo has seized the opportunity to boost its smartphone division. Thanks to its strong foothold in the PC territory, Lenovo is able to leverage its high brand esteem and knowledge while establishing a successful distribution network all over the country. By focusing on medium-low end markets, Lenovo has increased its market share from 5 percent in 2011 to 10.4 percent in 2012, while Apple’s and Samsung’s dropped by 2.1 and 5.8 percent. Since 2012, Lenovo has become the No.2 smartphone brand in China and No.5 in the world.

As one of China’s biggest technology brands, Lenovo enjoys long-established brand stature in the domestic market. Moreover, Lenovo smartphones have a strong relevance among the mass consumers due to the high cost-efficacy. The downside is that differentiation is greatly lacking for the brand.

Established Chinese Brands Are Building Brand Stature in the Global Market

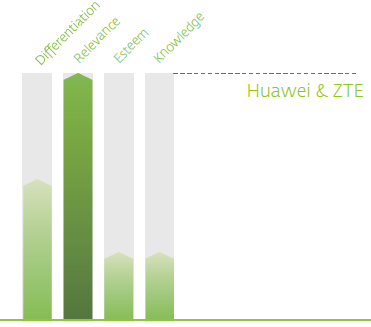

Founded in the 1980s, China’s two telecom giants Huawei and ZTE have established successful B2B businesses in over a hundred countries around the world and their newly branched-out smartphone divisions are fast expanding. Huawei and ZTE have now become the 3rd and 4th biggest smartphone brands (Lenovo the 5th) in the world in the final quarter of 2012. Both brands used to produce quality white-label products for other smartphone vendors. With solid technical expertise, Huawei and ZTE have been steadily pushing medium-low end smartphones to the Chinese and global markets.

However, despite the increasing shipment number, many consumers remain doubtful about these two Chinese companies as credible smartphone brands. The challenge ahead for Huawei and ZTE is to establish brand esteem and knowledge among end consumers, especially in the global markets.

Globally, Huawei is set to enhance its brand esteem by launching premium devices. During this year’s MWC, Huawei unveiled its latest premium model Ascend P2 with high performance features. Also, a global branding campaign “Make it Possible” was launched manifesting Huawei’s determination.

In the meanwhile, ZTE showcased great product range by announcing high end “phablet” Grand Memo as well as a Firefox OS device ZTE Open that is meant to target the low and emerging markets. ZTE is elevating its brand by putting extra effort in product design. The brand’s Grand S and Grand 3 models were recognized with the iF product design award in 2013.

Recent statistics showed that although Chinese brands constitute over 80% market share in China’s cellphone industry, they only enjoy less than 5% of the total profits. The fierce price war among lower end brands not only greatly limits Chinese brands’ profitability, but also affects the quality of their products and harms their brand esteem. Even for high end models, Chinese brands have to suppress the price in order to compete with more popular global brands. So how should these Chinese brands further enhance brand equity and create value?

Be Innovation Driven

Innovation is one of the fundamental elements contributing to a brand’s success, and this is especially true in technology industries. Whether developing a custom Android skin or experimenting with new OS’s, most of today’s rising Chinese smartphone brands are innovative in a way. Still, to make a difference in this highly competitive market, one must bring something unexpected to the table, be it a new technology or a refreshing design. Chinese brands need to be even more innovative and differentiating in order to match to the big names.

A good example would be Asus. In fact, taking another look at this year’s MWC, Asus might have generated the greatest buzz by bringing its cutting-edge PadFone Infinity. Bearing in mind the motto of “Innovation Beyond Expectation” , Asus has launched a series of innovative devices over the past 10 years, from Eee PC to Transformer AiO. Widely acclaimed for its innovative and adventurous spirit, Asus has established a convincing image of technology expert and innovator in front of its global audience, which isn’t always easy for a Chinese/Twaiwanese brand.

Consistent Brand Identity and Communication

In terms of overall brand building, many Chinese smartphone brands excel in some aspects but fall short in others. For instance, ZTE received several awards for its smartphone designs, but the company’s official website remains in an old-schooled fashion that doesn’t match the level of aesthetics and sophistication that the brand is trying to embody. Eventually, the lack of consistency in brand communication touch points will leave the audience confused about what the brand stands for, thus compromising brand knowledge.

Xiaomi has taken the extra step that helps it attract a group of strong believers. Other than its usual products, Xiaomi has developed a line of periphery products from moppets to T-shirts that centers on the brand mascot Mi-bunny (or Lei Feng bunny). The “cool-looking” Mi-bunny wears an iconic communist army hat and a Young Pioneer red scarf that evoke a mixed sense of patriotism, nostalgia, humor and edginess. By doing so, Xiaomi extends its brand influence, and more importantly it interprets its brand value, which its audience can relate to and echo with.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.