In the realm of conferences like Millennial 20/20, Marketing to Millennials, and Millennial Summit, the spotlight is on Generation Y, a group of tech-savvy individuals with growing spending power. While ‘millennials’ is a broad term, encompassing diverse segments, this article narrows its focus to ‘millennial travelers’ within the hospitality industry in Asia. Delve into the unique preferences of Asian Millennial Travelers aged 20-35, exploring how their tastes vary across locations, cultures, and more.

“There’s give-or-take the same number of the 20-35 year olds in China as the entire population of the USA. You don’t advise a brand to assume everyone in USA is the same, so why would you advocate that 20-35 year olds be stuck into a single grouping? Brands need to find smart ways to segment, so that they know who specifically to speak with and what to say.” – Chris Wallbridge, Business Director of Research, Labbrand Shanghai.

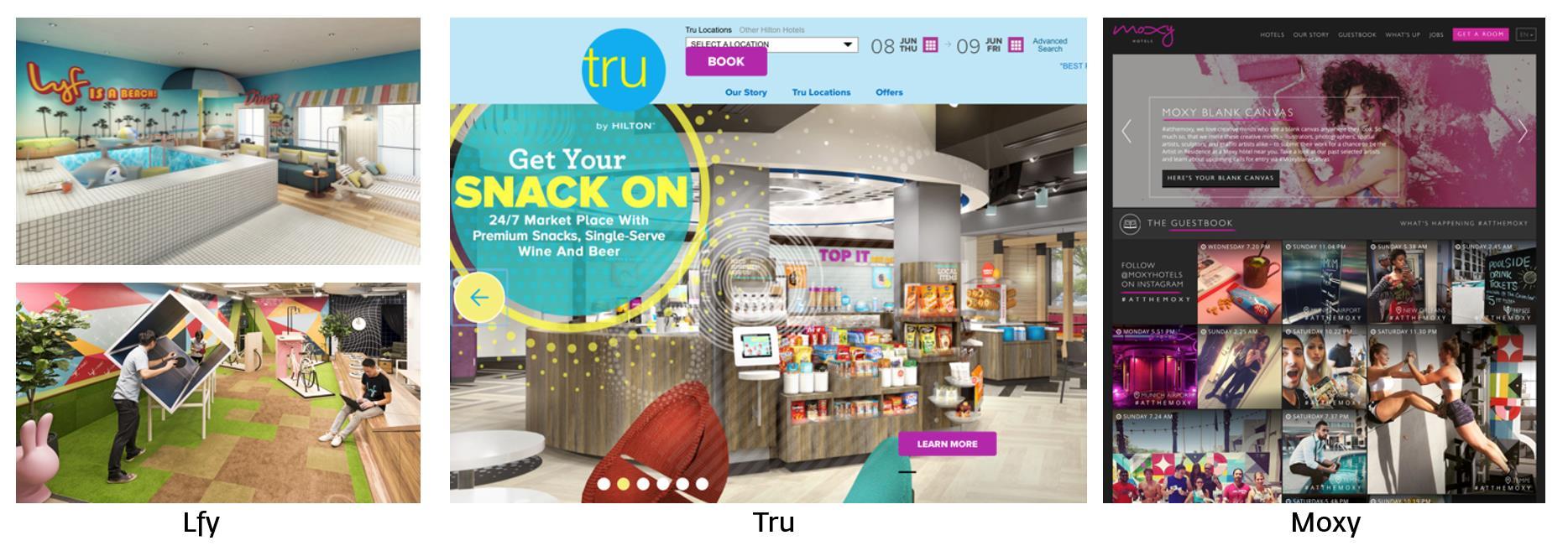

Despite the ambiguous title of ‘millennials’, it is undeniable that these consumers have changed the way brands operate. In the hospitality industry, we are seeing the birth of new younger, edgy brands with the intent to attract the hyper-connected millennial travelers. Brands like Moxy (by Marriott), Radisson Red (by Radisson), Tru (by Hilton) and Lyf (by Ascott) are just some of the newly created brands with bright bold colors and communal live, work and play spaces. Airbnb is a success case whose proposition of authentic local experience has gained popularity among millennial travelers and disrupted the traditional hotel industry. Most recently, Airbnb has also hinted at expanding into the airline booking industry.

From left to right: Lyf (by Ascott), Tru (by Hilton), Moxy (by Marriot)

While developing new brands allows for the freedom of a clean slate – without the baggage of existing operations and brand image – not all is lost for companies that are not ready to launch new millennial-focused brands. Let us examine some of the ways traditional hospitality players like hotels and airlines increase their appeal to the millennial travelers.

Even for traditional companies, younger consumers are changing the game. Gone are the times of the industrial period with a product-centric approach. Moving into an era of consumer-centric experiences, it is important for brands to understand the target consumers and their preferences to truly deliver a customer-centric experience. Cookie-cutter guided tour packages with fixed itineraries are a thing of the past for young travelers. They want to travel and see the world in their own way. They want to eat paella in Spain, but prefer it freshly cooked from the kitchen of a Spanish grandmother. They want to have coffee in an Italian café, but in a cafe that is full of locals, hearing a language that they do not understand. They want personal, authentic and unique experiences that earn them a ‘social currency’ that boosts their online identities, something they take pride in cultivating.

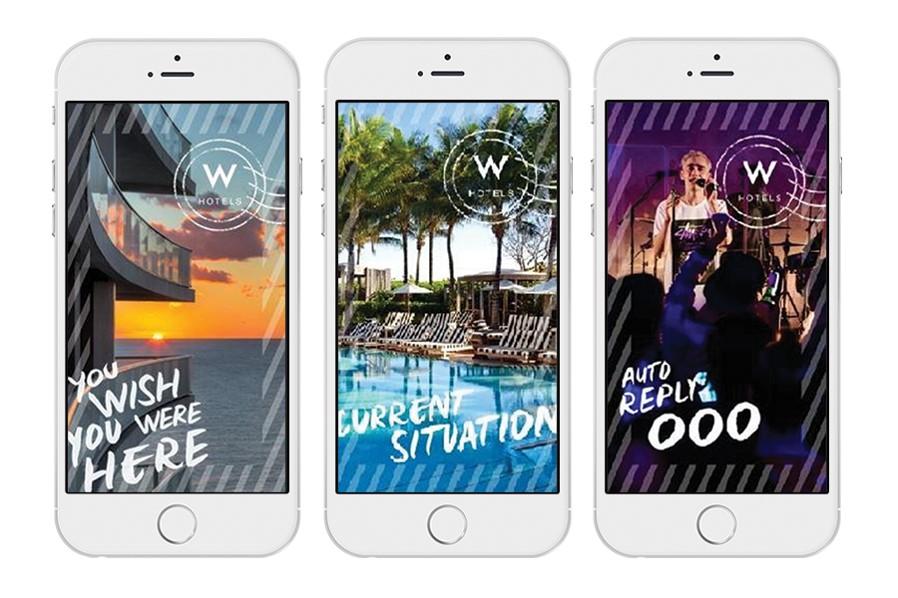

As part of their online identity cultivation, millennial travelers have the desire to document every moment of their travel experience on social media with videos, photos and status updates. It is therefore not surprising to have free wifi at the top of the travel wish list. For brands, this means exposure opportunities with these millennial travelers as “ambassadors”, just like W Hotels’ recent Snapchat filters. Speaking in hashtags, providing Instagram-worthy selfie spots, simplifying content into bite-sized consumption, and integrating Snapchat and Instagram stories are ways into younger traveler’s social media space. But what most traditional brands fail to realize is that editorial content and style is important to these travelers. There is nothing personal or Instagram-worthy about images of a sterile hotel room with the perfectly-made bed or an air stewardess full of smiles. Instead, ruffled, slept-in sheets and Japanese green tea brewed by the air stewardess are reflections of authenticity.

Snapchat filters from W Hotels

While millennials’ fluid consumption of content across multiple platforms and devices creates more opportunities for brands to reach, engage and drive bookings, it also means it is important for brands to be “always on”, 24/7. The millennials want their voice to be heard, anywhere and anytime. For hotels and airlines to sustain the loyalty of this group, direct communication and engagement must be established.

We know that millennials differ from country to country, shaped by culture and lifestyle differences, and this is even more pronounced in Asia where the culture is diverse. Within Asia, 60% of the population is made up of millennials. In the study by the Singapore Tourism Board, it is cited that millennial travelers spend 35% of the $600 billion Asians spend on international travel. By 2020, it is estimated that millennials will spend $340 billion on international travel, an increase of about 62%.

“Proximity between destination and home market is a useful differentiator: the further away, the higher the daily budget tends to be. So if a key target group is young Chinese travelers, your strategy and what you offer them in, say, Australia is quite distinct compared to what is offered in Thailand. Again, brands need to go beyond using a generational cohort approach.” – Chris Wallbridge, Business Director of Research, Shanghai

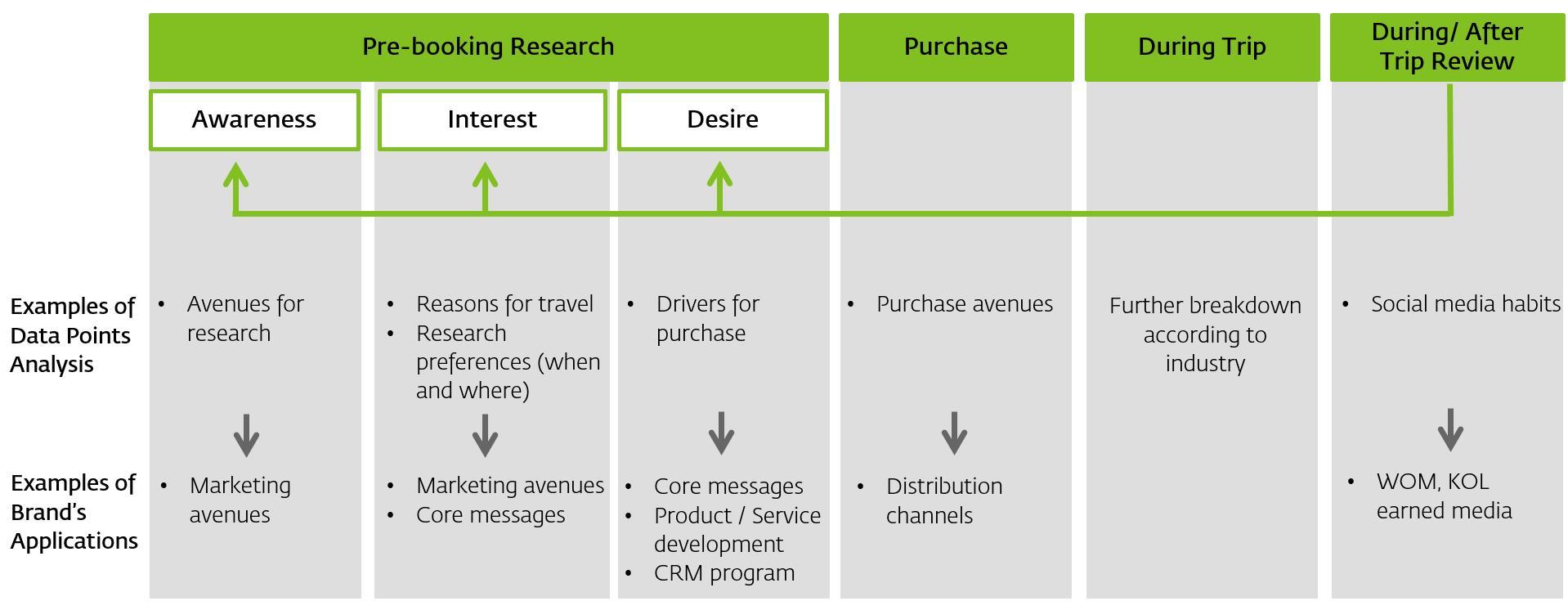

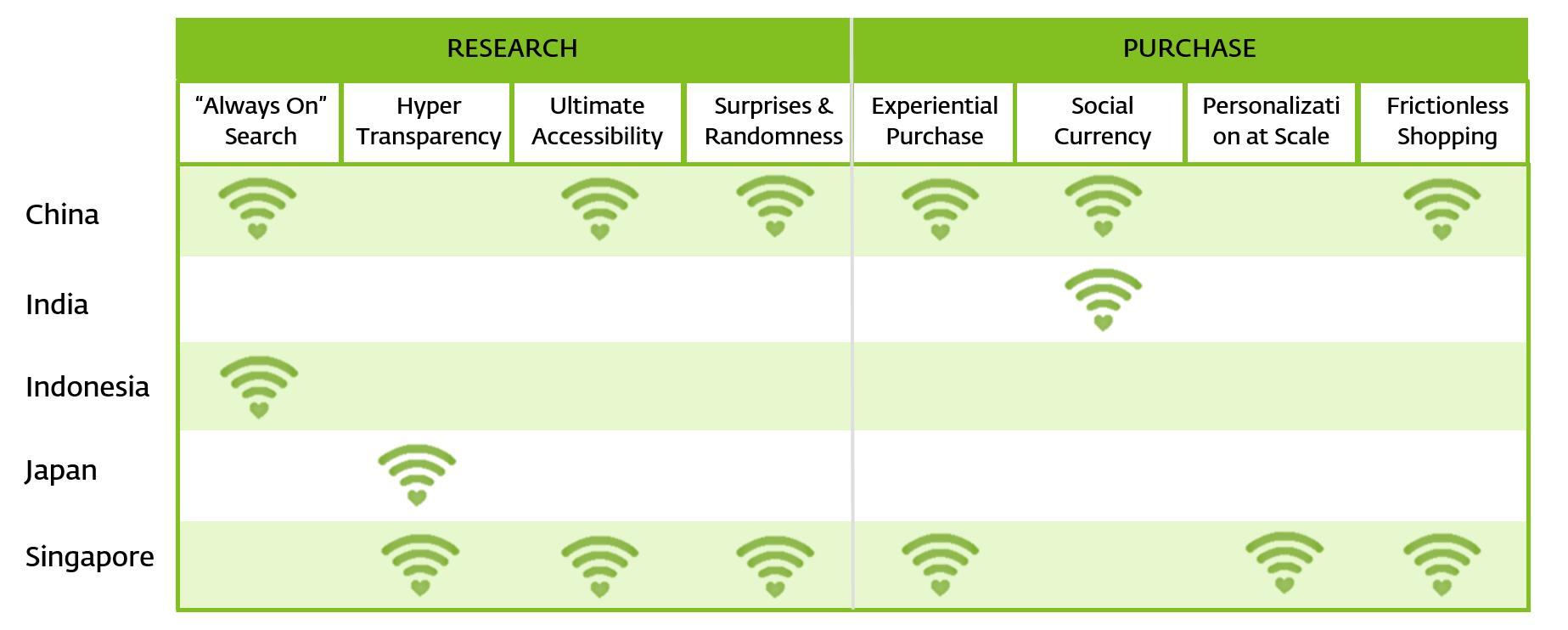

Knowing the subtle differences in the travel mentality and behavior of these Asian Millennial Travelers (AMTs) will empower travel operators and brand owners to allocate the right resources and focus on aspects that truly matter at different stages of the customer journey, illustrated by the table below.

The customer journey for the millennial traveler

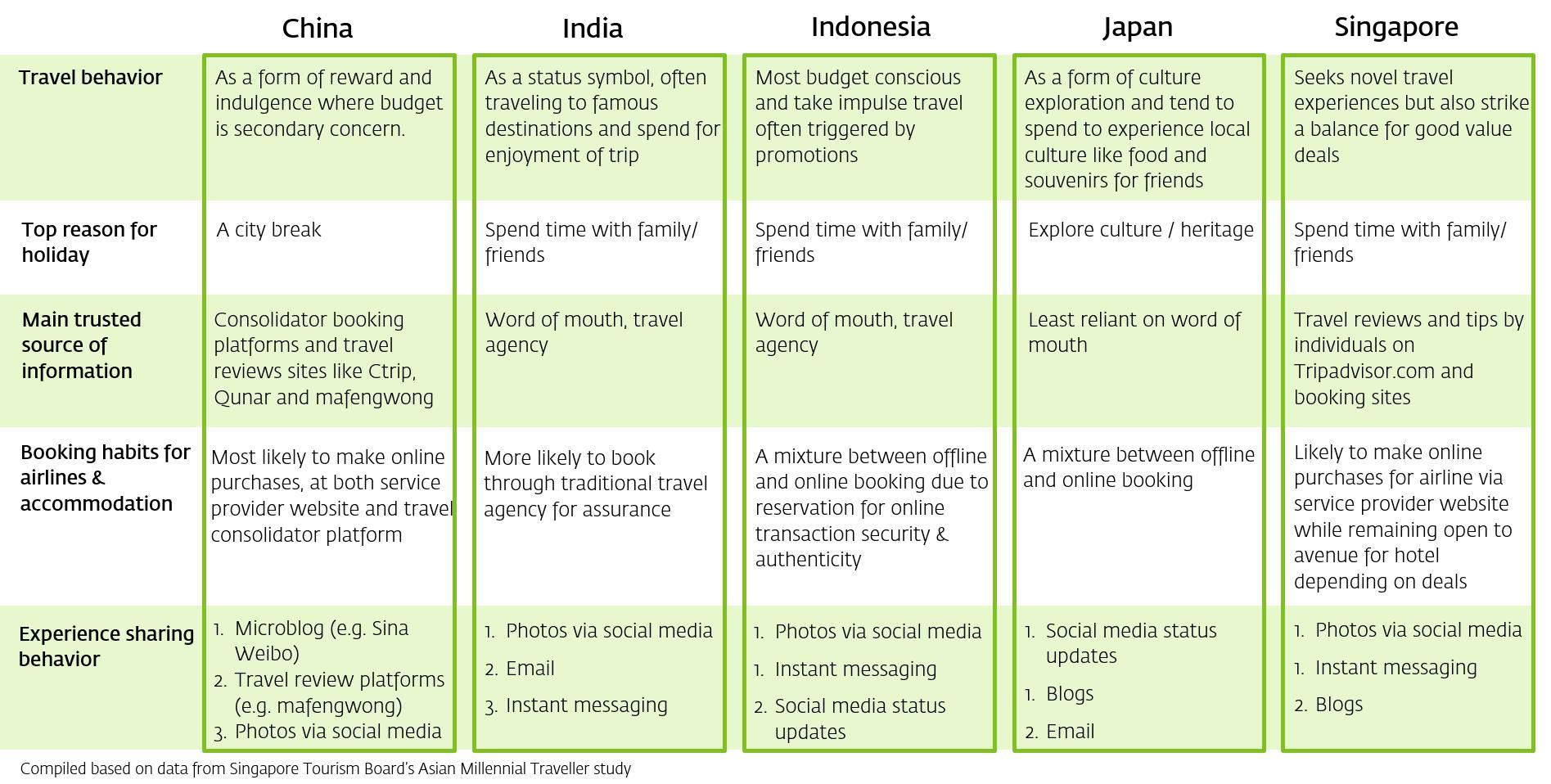

Borrowing the learnings from a previous study by, MADJOR, Labbrand’s digital transformation agency, there are common traits displayed by millennials at different stages of the customer journey. While there are indeed common traits, different traits are more pronounced in different countries; integrate this with the travel mentality and behavior of AMTs across countries and it leads us to different brand applications in each country. Taking research and purchase stages as examples, we see stark differences between millennials in China, India, Indonesia, Japan, and Singapore.

Asian millennial travelers of different countries: China, India, Indonesia, Japan, and Singapore

Priorities and focuses of Asian millennial travelers in different countries: China, India, Indonesia, Japan, and Singapore

Indian millennial travelers tend to be more traditional when compared to their counterparts in other parts of Asia. With travel being a reflection of social status, it makes more sense to convert purchases into social currency, which adds on to the overall feel-good emotional bank – even before embarking on the trip. Airlines that collaborate with travel agencies on campaigns via a call to action (i.e., tagging friends on social media after their purchase) succeed in adding the social currency dimension for IMTs, while also activating positive word-of-mouth for the airline.

While Indonesian millennial travelers display similar traits in terms of preference for offline purchases, they are also more budget conscious, resulting in heightened awareness during the research stage of the customer journey. This indicates a higher emphasis on collaboration between travel agencies and social media in the Indonesian market with frequent promotions that drive engagement.

Japan, on the other hand, has a high portion of solo travelers – young single females with the propensity to travel before marriage. Highly dependent on own research instead of word-of-mouth, ‘hyper transparency’ from the brand is deemed more valuable to Japanese millennial travelers. Brands that go beyond transactional listing of products and services, and also display traces of belief-systems for preservation of local craftsmanship, as well as sharing of insights into foreign culture, appeal to Japanese millennial travelers. Sharing of highly-personalized content based on local culture and heritage, digested before a trip, helps them in the planning of solo travels.

Millennial travelers from China and Singapore display characteristics strongly related to general AMTs; however, it is noteworthy that travel motivations and drivers differ in each country. ‘Surprises and randomness’ take on different meanings in Singapore and China. In Singapore, millennial travelers seek surprises in the travel experience that they are buying into, whereas Chinese millennial travelers are drawn towards surprises and randomness in marketing communication and campaign execution.

Young consumers often referred to as the millennial generation pride themselves on being unique and distinctive. As such, their attitude and behavior is always evolving. What we know about AMTs today may not be the same tomorrow, particularly as the culture of different regions grows and expands. Smart brands are those that adopt the mindset of constant adaptation, listening closely to their customers and staying sensitive to cultural differences.

Are you still treating millennials as a homogenous group?

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.