With the rise of disposable income and the development of a thriving consumer culture, spending on products related to personal appearance in China has skyrocketed over the last decade. This trend has impacted numerous categories such as fashion, hair care, beauty services and cosmetics. However, one product category appears to be getting less attention: fragrances. As more and more perfume brands are looking to tap the Chinese market’s growth potential, Labbrand decided to take a closer look at this market, analyzing its key drivers, understanding consumer perceptions and identifying major challenges for brands.

METHODOLOGY

KEY FIGURES

Analysis of market figures raises certain contradictions. While the cosmetics/beauty care market as a whole has been booming and focuses on appearance borders on obsession for many consumers, the fragrance market has not partaken in the explosive growth and shows growth rates well below those for the global cosmetics/beauty care market (18.8% vs. 12% YOY growth in 2011). From 2012 to 2016, the market is expected to grow at an even slower (yet still healthy) pace of 8%, growing from 4.23 billion RMB to 6.24 billion RMB. Interestingly, we also see that while men’s cosmetics are a booming category, the share of men’s fragrance in the total market value is actually set to decline.

Market and consumer

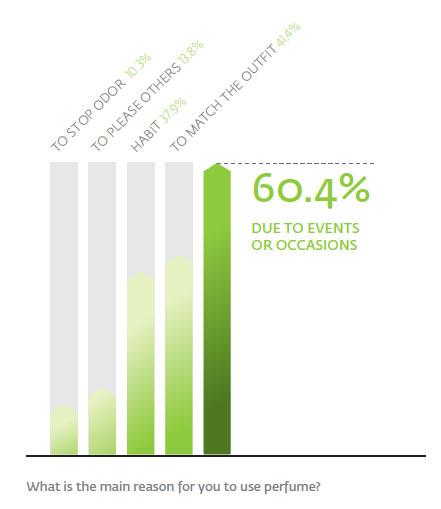

In our view, the key reason behind the Chinese fragrance market’s comparatively weak growth can be found in Chinese consumers’ very pragmatic conception of beauty. Beauty is perceived as an asset, a tool that serves certain ends (getting a job, securing a promotion, attracting a good partner, etc.). As discretionary income rises, spending goes towards hair care and skin care products whose benefits are perceived as more tangible. Perfume on the other hand is not viewed as offering significant enough customer benefits to justify the (considerable given average income) expense. Discussions with customers on the ground confirm this relatively unclear perception of fragrances as a product category. In general, this could be because Chinese consumers have little known history of perfume use. As high-end fragrances are still a relatively new product category, especially in T2+ cities, product knowledge is still fairly limited.

According to our online survey, around 70% of the people in T1 cities have purchased perfume over the past 6 months, whereas the number in T2+ cities falls to about 42%. However, since respondents were concentrated in younger, mid to high income groups we can reasonably assume that these figures are at least 10 percentage points lower for the general market. Amongst frequent perfume buyers, brand loyalty appears to be high with most people interviewed sticking to a same brand over time. A 29-year-old woman from Hangzhou told us that “There is no point of exploring other brands after you have found a satisfying brand. In my case, it’s Dior.”

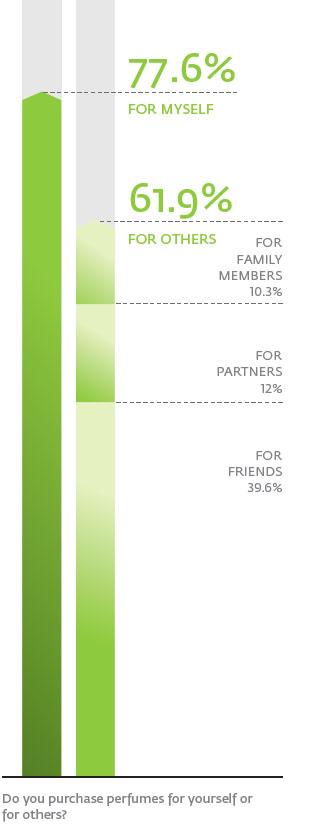

Drivers for purchase vary but gifting still plays a very important role in driving the market. Perfume is often used as an entry price point luxury gift that represents a safe choice because it carries the name of famous brands. During our field interviews we met 3 girls from a Tier 2 city in Anhui who only purchased fragrances for gifting purposes. However new customers are more willing to consider perfume for themselves and future market growth will mostly come from purchases for self.

When being asked what concepts and ideas they link perfume to, the most common answers customers gave were taste and elegance. It is worth nothing that, 15% of the survey takers in T2+ cities linked perfume to social status while none of the respondents did so in T1 cities. In terms of differences in perceptions between genders, over 50% of men associated perfume with seduction while the proportion of women to do so is only 20%.

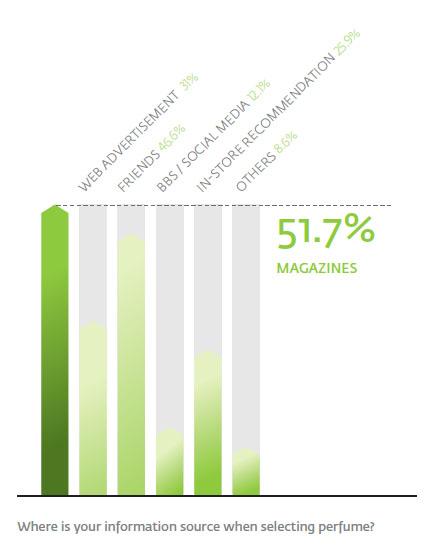

When it comes to selecting perfume, about half the men surveyed will ask their friends or girlfriends for references, while 70% of the women think it is more of a personal choice. In face to face interviews, 50% of the girls said that their choice was already made before entering the shop and that fashion magazines and friends’ recommendations were the most important influencers.

Brands must also pay attention to typically local elements such as the “cute” (可爱) factor. Unlike in western markets, “cute” is an attribute sought even by women in their mid-20s and interviews with salespeople indicate that the search for “cuteness” often influences product selection. Another quintessentially local characteristic of the market can be found in regional differences in tastes. Women from western and southern regions for example are said to favor more fruity fragrances while women from the north may be more drawn towards herbal or mineral scents. Brands must go further in identifying these regional preferences and integrate them into their distribution strategy to ensure that product assortments match local expectations.

Due to limited product knowledge and the importance of gifting, Chinese consumers heavily favor fragrances from famous brand names. A look at top sales shows that the Top 10 best sellers are dominated by brands such as Dior, Chanel, Burberry or Hugo Boss who derive their brand equity from their other activities. Current consumption drivers and low product knowledge make it challenging for specialized fragrance brands to gain market share, although we believe that as the market matures in T1 cities and a new category of consumers more focused on self-expression gains spending power, more niche brands will emerge.

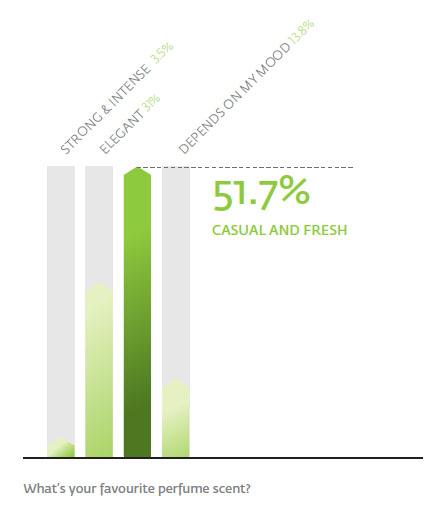

In terms of the preferred type of fragrance, Chinese consumers overwhelmingly choose subtle, fresh fragrances (with some regional differences as mentioned above). Over 50% of online survey takers declared preferring casual and fresh scents while only 3% ticked “strong, intense fragrances”. A 32-year-old native Shanghainese man confessed that intense fragrances on women make him nauseous and that he prefers lighter scents that he believes better convey the elegance and cuteness associated with femininity in China. When choosing fragrances for themselves, men are drawn towards fragrances with a “clean” feeling. Much like what we see in the beauty care sector as a whole, fragrances are not supposed to make the user stand out through bold statements of originality.

Without a doubt one of the greatest obstacles in the way of the development of the Chinese fragrance market is distribution. Fragrance is a category for which an on-site or in person experience is important, especially in relatively immature markets such as China where retail operations and information are crucially important in building product knowledge and driving discovery. However in China, retail networks are scattered with very few specialized retailers and an over-reliance on department stores. This environment makes it difficult for brands to control product assortment, carry out point of sale operations and achieve high market coverage across city tiers.

Field research conducted by Labbrand confirms these challenges and shows that even in Shanghai, most points of distribution carry few brands and that those who do often offer poor experiences. There are few places that offer both a quality shopping experience and a large selection of products from different brands at different price points. Thus, opportunities for discovery through retail are currently limited.

On the communication front, perfume brands do not appear to be localizing their marketing strategies for the Chinese market. Ads and communication material are mostly just translations of global campaigns. This lack of communication localization is probably best reflected in the very feeble Chinese digital presence of global fragrance brands whose presence on local social media platforms in particular is either minimal or non-existent.

Given the unique challenges fragrance brands face in the Chinese market and Chinese people’s unique perception of beauty, we believe that brands should go much further in localizing their communication strategies, focusing on education about the product and how to use it, establishing a better local digital presence and framing the products benefits in ways that are more locally relevant.

OUR RECOMMENDATIONS

Solve the issue of retail: As long as the problem of retail remains, it will be hard for the market to truly take off. Brands must address this issue by taking control of their China distribution and collaborating more closely with established chains to ensure optimal market coverage. They must also be more ambitious in creating innovative in-store operations that can drive first-time purchase and introduce the brand to a larger audience. E-commerce if used wisely can also be used to create quality shopping experiences and reach out to consumers in T2+ cities (see below).

Educate: Along with retail, customer education is the main drag on brand performance in the market. The challenge for brands is to go beyond the perception of perfume as a generic entry level luxury good, creating a real culture around the product, promoting more frequent use and embedding it more deeply into local habits. This effort will require considerable investment in the form of rich, localized brand content and special retail operations but is a necessary pre-condition to future market development.

Use digital: Perfume brands are currently in a situation where they must generate exposure to drive product knowledge and brand awareness. This objective can be attained for a limited price through well designed digital campaigns that leverage social media. Moreover, digital can be used to better personalize brand messages and inject a social component into the purchasing process. As such it is a very relevant channel for a product that has heavy links to personality and for which the purchasing process and motivations for use are very social. Digital can also be used to drive education on a broad scale through engaging online content. Finally, e-commerce can be part of the solution to the problems posed by poor retail networks. Through a quality, well localized e-commerce presence, brands can reach out to a broader audience, especially in T2+ cities where retail networks are lacking and e-commerce plays a strong role on consumption habits.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.