Explore the unique landscape of the high-end cosmetics industry in China, an emerging market with distinctive trends. While North America and Europe boast mature markets where cosmetic surgery is prevalent, China’s high-end cosmetic sector is in a dynamic early stage. Uncover the latest cosmetics trends in China as the desire for beauty takes on culturally relative meanings in this evolving market.

To unravel the intricate cosmetics trends in China, Labbrand embarked on an extensive video qualitative research project in Shanghai. Through direct interviews with cosmetics users at their point of purchase, Labbrand delved into seven key themes, including beauty attributes, cosmetic brands, skin concerns, daily care routines, beauty expenses, product attributes, and store/spa concepts. This comprehensive approach offered valuable insights into the Chinese perception of beauty, consumer habits, and expectations from the cosmetics industry. The research, focused on Shanghai, provides a nuanced understanding of the evolving trends in this dynamic market, shaping the future landscape of beauty preferences and consumer behaviors in China.

To conduct this survey, Labbrand focused on four crucial dimensions of the market: the consumers and the different consumer segments, the trends regarding the products, the way brands communicate about their products according to the different market segments, and the distribution channels.

This article will outline the main results of the research and discuss opportunities for foreign brands in the Chinese cosmetic market.

Research Project Details

Market and Consumers

When discussing the differences between men and women, it has been said that men are from Mars, and women are from Venus. Although Chinese male and female consumers are on different planets, they definitely belong to the same solar system. Specifically, although the two markets must be distinguished, the survey showed that Chinese men and women share the same underlying concepts of beauty. Beauty in China is considered to be a balance between physical and mental attributes that may be natural or enhanced. However, physical beauty is mainly perceived as a result of external assistance. While talking about beauty, the interviewees often mentioned “happiness”, which refers in Confucianism to the values of success, fun, health and education, to name a few.

For Chinese people, beauty is part of a happy life, which explains why Chinese consumers are so interested in cosmetics and spend a lot of money on beauty products. As Charles, a 28-year-old man, says, “the trend (in cosmetic products consumption) is going to be stronger and stronger, because people want to be beautiful, they want to be trendy and make up and skin cares are part of the fashion, they are part of your life.” Moreover, several interviewees, mainly women, said that their monthly expenditure on beauty and skin care products reached 1,000 RMB (about 150 USD). Although many Chinese consumers, in Shanghai and elsewhere, still struggle to earn 150 USD per month, the wealthy market segment represents a growing and highly lucrative consumer group that both foreign and domestic brands may choose to target.

Chinese men and women also share specific behaviours regarding their consumption of cosmetics. Chinese cosmetics consumers are generally not very loyal to brands. “You don’t need to choose a product because it belongs to a brand, for each product you have to find the one that better fits your skin; it does not always have to be from the same brand” explains Ren, a 31-year-old woman. Chinese consumers like to try several brands to compare them. Another characteristic of Chinese cosmetic consumers is that they exhibit seasonal consumption of products. In Shanghai specifically, due to the significant difference in climate between winter and summer months, Chinese people change their habits according to the season. In summer, they will use more sunscreen cream to preserve the whiteness of their skin, and less thick and oily cream than they do in winter months.

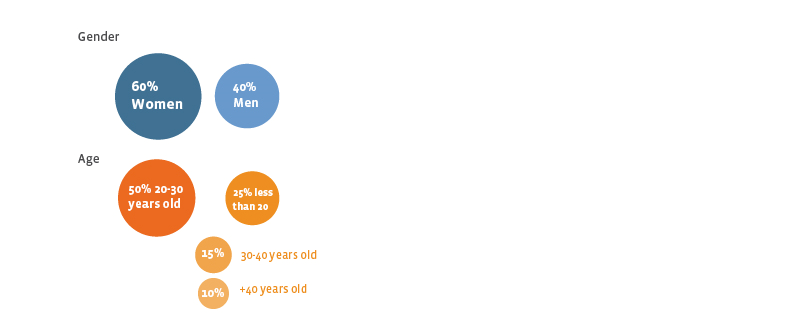

However, although men and women share the characteristics mentioned above, the two markets have not yet reached the same level of maturity. Women are a well-educated cosmetics market, whereas men are still only emerging. The steps of becoming a regular cosmetic product consumer are the following: first you become aware of a problem, and you acknowledge the need of external help to deal with it; then you start using cosmetics products as a treatment to solve this particular problem. As you notice the positive effects of the products, you start using them daily. At this stage you become a long-term consumer; you acknowledge your basic needs and start developing new ones. While women are already at the last stage of this process, men are only starting to notice the benefits of cosmetics, and to become daily users of beauty and skin products.

When communicating about and advertising for their brands, it is necessary for cosmetic companies to take into account differences between the maturity of the male and female cosmetic markets. As women are aware of their needs and have general knowledge of the products, advertisements aimed at women will focus on explaining the products, their ingredients and their specific effects on the skin. Thus, a scientific approach will be favoured for the female market. On the other hand, for the emerging male cosmetic market, advertisements should highlight daily steps and the visible results the products will have on skin.

In terms of communication, the interviewees underlined the effectiveness of international brands. Sha, a 23-year-old man, says that “international brands are really efficient when it comes to marketing and communication; their ranges of products are really clear and detailed regarding their functions.” Chinese consumers seem to believe that international brands should keep their identity as foreign brands. According to Charles, previously mentioned, “they don’t really need to fit the Chinese market; they just have to be themselves. They introduce their brand and their culture, that’s important. They have to do a lot of things on image in the details, it’s very important, that’s the spirit of French brands. It’s delicate, good quality, this is how we think about French brands, they have to keep it and I think they will be successful.” Although the foreign brands may wish to maintain their identity, they often still need to adapt slightly for the Chinese market by using a compelling Chinese name or packaging design adjusted for local cultural codes. (See our previous articles on “Why do you need a Chinese name?”, and “Advertising Decoded” for more information.)

Chinese consumers have a strong need to communicate with brands, and to share their experiences. As previously mentioned, Chinese consumers like to try many different products and brands, and talk about them to compare and finally find the most suitable ones for their specific needs and desires. This need to communicate with brands was clearly expressed in our survey. Li, a 19-year-old girl, says: “I want brands to ask for my opinion after I have tried their products. I want brands to quickly alert me when they have special events so that I can buy the new products.” Word-of-mouth is also a powerful tool in China, especially for cosmetic products. Some people will only buy products if they have been recommended to them by friends.

There is a distinct preference in China towards cosmetic products using natural ingredients. Chinese consumers fear the risks of chemical products and are strongly convinced that natural products are more efficient that chemical ones. For example, a 22-year-old male named Yan, said “I would like a natural product made from fruits and vegetables that would use few chemicals that would be safer and give better results on skin”. Chinese consumers tend to rely on the smell to judge how natural a product is. Li, a 27-year-old woman, says “I’ve used l’Occitane, it’s good, but the products smell really strong, so I’m worried they put some chemical perfume inside. Sisley products smell like medicines and are made from plants which is natural, I like it.”

This preference for natural products goes along with a strong attachment to Chinese Traditional Medicine (TCM), a significant part of the Chinese culture. Through the survey, we uncovered that Chinese consumers generally associate TCM with quality, safety and efficiency in the long-run. Some companies have understood this trend and have seized the opportunity: new brands using TCM are emerging throughout China and Europe, like Herborist. Herborist is a Chinese cosmetic brand, using TCM in its products. “The Herborist products are made of herbs, from the traditional Chinese medicine techniques, they smell very natural, so it’s good for beauty, you feel happy and relaxed.” (Xun, 22-year-old woman) This brand is very successful in China, and has even started to export its products to Europe. For example, in France, the famous brand Sephora advertises for Herborist. In its promotion for Herborist, Sephora insists on the Chinese and traditional dimension of the products, using packaging featuring the yin/yang symbol, which is one of the most famous aspects of the Chinese culture in French people’s minds.

In China, there are two main distribution channels for high-end cosmetic products, namely luxury department stores and spas. Department stores are convenient and they target a wide range of consumers. They generally offer 20 to 30 different brands, from mid to high-end. It is easy for customers to find products because each brand has its own counter. Chinese people generally like to go to department stores, because they like to buy, try and use different products and brands. Furthermore, going shopping is a popular pastime among the Shanghaiese.

Another efficient distribution channel for cosmetic products in the Chinese market is spas, which provide both cosmetic products and relaxing treatments in sophisticated environments. Massages and spas are part of Chinese habits— 60% of the interviewees said they went to spas several times a year. Men go to spas more than women and are regular massage customers, perhaps due to their high pressure and stress at work. However, people under 20 years of age almost never go to spas because they cannot afford it.

In Shanghai, we can observe two main kinds of spas: fashionable and traditional. A highly fashionable spa in Shanghai is the recently opened Barbie-store. This luxurious SPA provides beauty treatments, hair and nail services and skincare products to “Barbie girls” of all ages, in a modern, “fashionable” environment made of flashy plastic furniture and an electro-pop music atmosphere. On the opposite end of the spectrum, the Herborist-branded spas are among the most traditional spas in Shanghai. The natural and Zen-like atmosphere of these spas, conveyed through the use of natural and solid materials and the sound of waterfalls, reflects the traditional methods used for treatments, and the natural aspects of the products sold. Moreover, the fact that Herborist is a branded spa chain is well-perceived by the customers. They already have a brand image of Herborist products in mind, and they naturally trust the Herborist spas for delivering the same quality, and same respect of tradition.

The results of this survey provide a picture of general trends in the cosmetic market in China, and based upon those trends, some opportunities take shape for international brands, whether they have already entered the Chinese market or not.

First, there is a real potential in the Chinese male cosmetics market which is only just emerging. At this stage, men are less aware than women of the technical and scientific aspects of beauty and skin care. As we stated above, brands have to focus their communication directed towards men on the basic utility of cosmetic products. International brands should have an advantage over Chinese brands, as they are perceived to posses a high standard of quality which can win consumer trust. So, the Chinese male market in cosmetics is definitely an opportunity for international brands who already posses a strong reputation outside of China.

Another opportunity for international cosmetic brands is to open branded spas. “I need to rely on the brand to go in its SPA. I go to SPA that has a network, such as Herborist, but never in the ones that just have one place. If there was a L’Oréal spa, then I would go there because it’s a good brand. If I have ever tried a brand that has a spa, then I would go in its spa,” says Xie, a 40-year-old woman. So, when a brand is successfully implemented on the Chinese market, a branded spa may represent an opportunity for it to further develop and reinforce its brand equity.

Would you like to learn more about cosmetics in Asia? Please contact Labbrand for a detailed presentation of research findings. info@labbrand.com

DOWNLOAD REPORT

A Labbrand Group Company © 2005-2025 Labbrand All rights reserved

沪ICP备17001253号-3To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.