Witness the flourishing landscape of Indonesia’s cosmetic industry, experiencing a remarkable growth rate of 9%, surpassing the projected annual GDP growth of 5.2% in 2019. This surge is propelled by both domestic and global factors, indicating a thriving market for cosmetic brands. The substantial demand is driven by an expanding middle class, comprising approximately 52 million individuals, boasting increased disposable income for non-necessity items. Explore the opportunities in Indonesia’s dynamic cosmetic sector and stay ahead in this burgeoning market for cosmetic brands.

Amidst the thriving cosmetic industry in Indonesia, both local and international cosmetic brands are strategically positioning themselves to capture a share of the lucrative market. In recent years, a wave of boutique homegrown beauty brands has entered the scene, introducing unique propositions that captivate consumer interest. Explore this article to discover how three boutique beauty brands are securing victories in the saturated market, demonstrating their prowess against larger competitors. Uncover the strategies that enable these brands to stand out and thrive in the competitive landscape of Indonesia’s cosmetic industry.

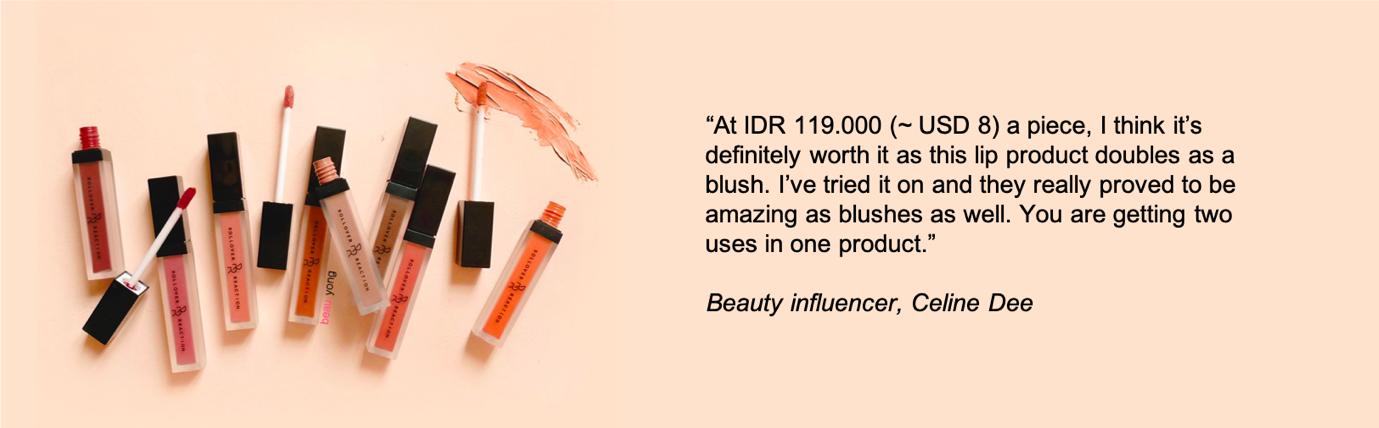

Launched in 2016, Rollover Reaction entered the Indonesia beauty scene with its first multi-functional product – a lip & cheek cream. The combination was atypical and was created by the brands’ founders observation of the essential products in Indonesia consumers’ make-up routine: lipstick and blusher. The product became an instant hit amongst consumers and set the tone for the Rollover Reaction brand, introducing other multifunctional products such as Browcara (for Brows and Mascara) and Luminizing sticks (Highlight, bronzer & blush sticks). Yet, multi-functionality is not new to the cosmetic scene. BB cream, which was made popular in the early 2010s, is one of the product pioneering this combination. Rollover Reaction’s success in Indonesia market can be attributed to the alignment of their offerings with the needs of modern Indonesian women – beauty as a form of self-expression at any time of the day.

To ensure that they are always looking their best, most Indonesian consumers carry with them a full set of beauty products (from cosmetics, perfumes, deodorant to tools such as eyelash curlers) in their bags wherever they go. This gives rise to consumers’ desire for quality, multi-functional products that are compact and lightweight. By combining the essential items into one, Rollover Reaction offers consumers novelty from the mix and a higher perceived cost-price value with their products, alongside the space-saving ability to counter a brimming make-up bag.

As cosmetic products are commonly used out-of-home, Indonesia consumers pay strong emphasis on the packaging design of their beauty products. Consumers expect the packaging designs to be either trendy or luxurious-looking, as it is evaluated as a social currency that defines their identity and social status. Understanding this, Rollover Reaction designed their packaging to be decked in bold colors yet minimalistic in design. Available in full-color blocks, the secondary packaging enables a strong color play when showcased with the entire collection and allows consumers to choose based on color shades that best represent themselves.

Examples of cosmetic products and packaging from Rollover Reaction

ESQA, inspired by Celtic word ‘Eska’ means pure beauty.

“We want our cosmetics lines to be beautifully packaged, innovative, safe, and natural, all at the same time. We were inspired by the trend in the US, where all the make-up artists are getting into healthier ingredients for their cosmetics products. We are proud to say we are the first company in Indonesia to produce vegan cosmetics.” says ESQA Cosmetics Founder, Kezia Toemion in an interview with Indonesia Tatler Magazine.

ESQA’s success is deeply rooted in the nature of its ingredient. Being free of potentially cancer-causing ingredients such as paraben, triclosan and gluten, the brand seeks to provide Indonesian women with a healthier alternative of cosmetics. This is in line with the global beauty trend of clean beauty, which is widely associated with claims that are “cruelty-free”, “natural” and “non-toxic.” The premise of which has also made ESQA more relevant to Indonesia consumers, who are reported by Nielsen to be socially conscious when it comes to purchasing goods and services.

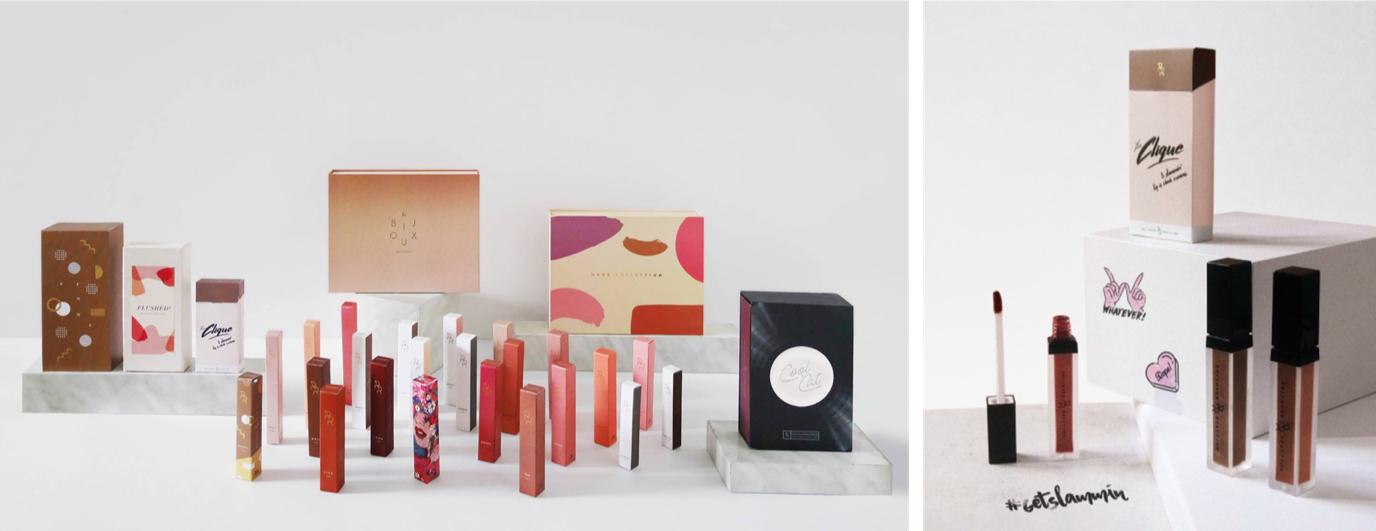

Examples of cosmetic products from ESQA Cosmetics

In the dynamic landscape of cosmetic brands, ESQA gains a competitive edge by aligning with the growing emphasis on halal beauty among consumers. Halal beauty entails products free from non-halal slaughter-derived ingredients, manufactured in a supply chain meeting halal requirements. While not identical, the ethical curation of ingredients in vegan and halal cosmetics resonates with Indonesian consumers, offering them a conscientious choice that promotes skin health and environmental sustainability. Explore how ESQA leverages this commitment to halal beauty to stand out in the market, catering to the evolving preferences of cosmetics consumers in Indonesia.

However, with the passing of the halal certification bill, which mandates all cosmetics products to be halal-certified by 2024, brands will soon be unable to capitalize on this trend and claim it as their competitive advantage. Hence, for ESQA, taking the “natural route” to pursue the environmental sustainable proposition, coupled with the quality products, will be the way to go as the brand expand its business footprints.

According to the global digital ecosystem report 2019, 1 in 2 Indonesian uses Facebook and approx. 1 in 4 Indonesian uses Instagram as a tool for information gathering or exchange. It is no surprise that brands are capitalizing on these platforms to build awareness and facilitate sales. For many homegrown beauty brands, getting brand awareness and consumers’ interest is one of the most difficult aspects of their brand building journey. Things, however, are slightly different for BLP Beauty.

BLP Beauty (also known as By Lizzie Parra), is founded by Elizabeth Christina Parra, a make-up artist and beauty influencer in Indonesia with more than 150,000 followers on Instagram. Capitalizing on Lizzie’s strong influence on social media amongst beauty enthusiasts, BLP Beauty made a name for itself quickly since its launch in mid-2016. Indonesian consumers were drawn to the brand – not only for products that are suitable and complementary to their skin tone, but also for its approachable, down-to-earth yet encouraging brand personality.

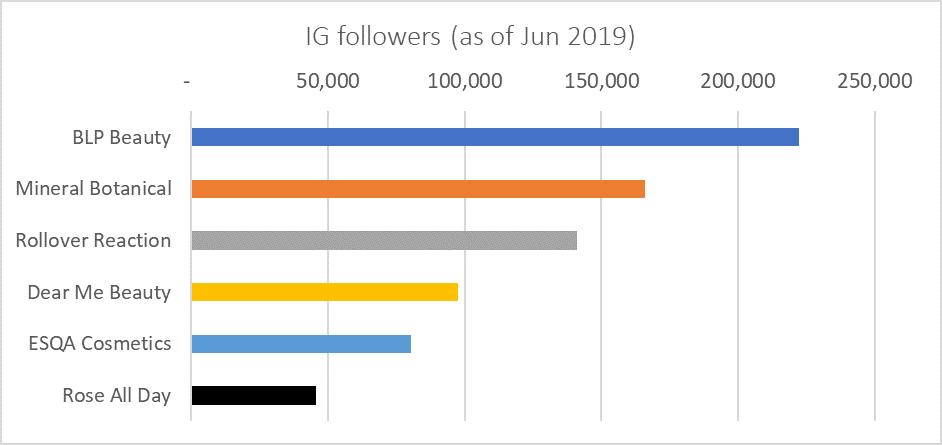

Labelled under Lizzie’s name, consumers’ interaction with the brand is perceived to be more authentic and credible than other boutique competitors as there is a face behind the brand. Consumers know who Lizzie is – her beliefs, the way she speaks and dress from the content she shares as a beauty influencer. They are also convinced of the quality, efficacy and usability of its products as these were backed Lizzie’s years of professional experience as a make-up artist. Threading on authenticity in its storytelling, BLP Beauty also creates content such as beauty tutorial posts on trending looks, or open questions to solicit consumers’ feedback, which keeps consumers highly engaged. This also translates to BLP Beauty’s social following – as the homegrown boutique beauty brand with over 222K followers on Instagram as of June 2019.

Comparison of followers numbers with other homegrown boutique beauty brands’ Instagram account

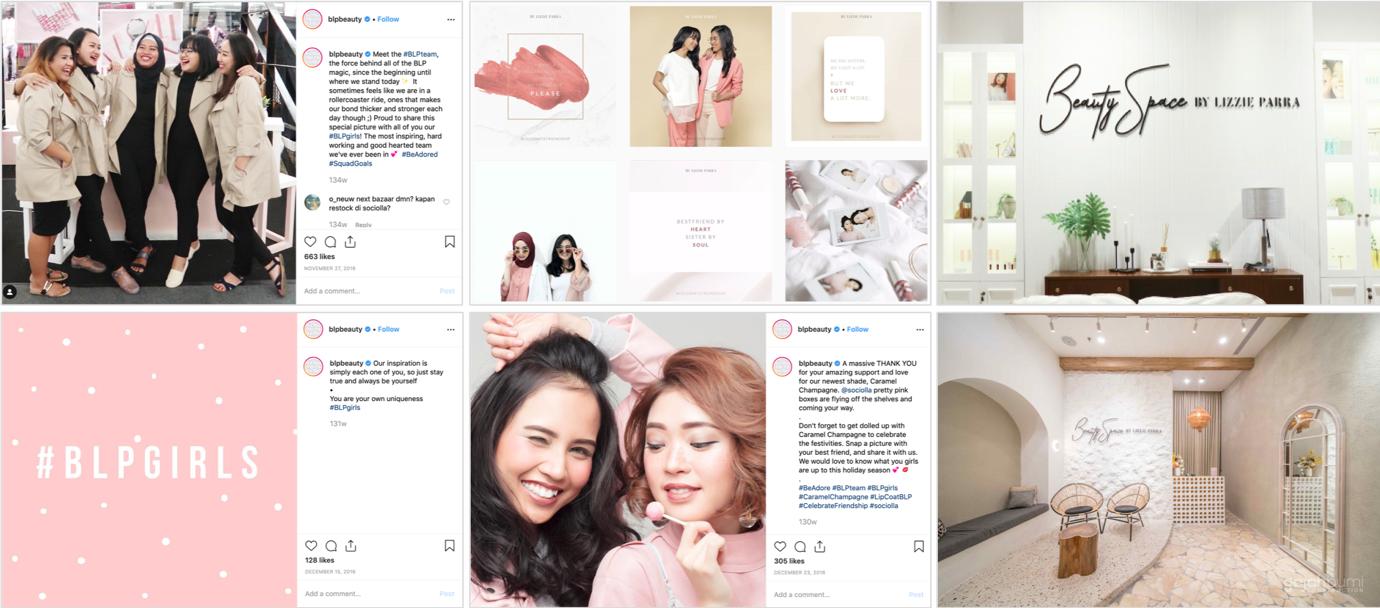

Another of the brand’s success factor lies in the beauty community that BLP Beauty has built around its team #BLPteam and its consumers #BLPGirls. The creation of specific tags enables digital-native consumers to identify with one another on social media, and thereby facilitate sharing among their social circle. The brand has also gone offline with retails stores “Beauty Space by Lizzie Parra” across the country in major cities like Jakarta, Surabaya and Bandung to expand their reach to a wider community of #BLPGirls. With each store designed as a living and family room, BLP Beauty encourages consumers to join their world of beauty exchanges and interactions, right where they feel most comfortable with themselves and their loved one.

(L-R) Social media posts on BLP community, campaigns, and BLP Beauty Offline stores

Though Indonesia cosmetic market is still predominantly dominated by international beauty brands such as L’Oreal, Maybelline etc, these young boutique homegrown brands are starting to give the bigger competitors a run for their money. Boutique players’ ability to integrate observations from consumers’ lifestyle and category usage with trending topics such as minimalism, mindfulness, social influence has enabled them to create innovative propositions that are appealing to the masses.

To do so, the boutique brands need to first identify the needs and expectations of their target audience, which have yet to be exhaustively addressed by the bigger players. Some of the questions that may be of interest include:

Answering these questions will better enable boutique brands to plan their brand and product strategies: from R&D, marketing and communication through to activations and distribution. There is no one-size-fits-all strategy, and one should not start by wanting to do it all. As a boutique brand where you operate on a territory where resources are tight, brands should consider what proposition is most unique about them, anchor it as the key driving force and play it up in their brand and marketing communications. After all, cosmetic brands are looking to hold a permanent place within consumers’ make-up pouches, and not be a sample or one-time usage item.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.