With a rumbling tummy, I took a seat in one of the restaurants that serves mouth-watering Indonesian cuisine in a bustling shopping mall in Jakarta, Indonesia. “Minum apa?” came the waitress. One looked around the restaurant and it was impossible not to notice that almost half of the people had ordered iced tea with their meals. Iced tea, or “es teh” in Bahasa Indonesian, is one of the most popular beverages enjoyed with meals among Indonesians. Freshly brewed or bottled, cupped or UHT, iced tea is being embraced in Indonesia due to the culture’s long affinity for tea drinking, albeit different than in Japan. Scroll down to explore the brand localization insights in our FMCG market entry research for “es teh” in Indonesia.

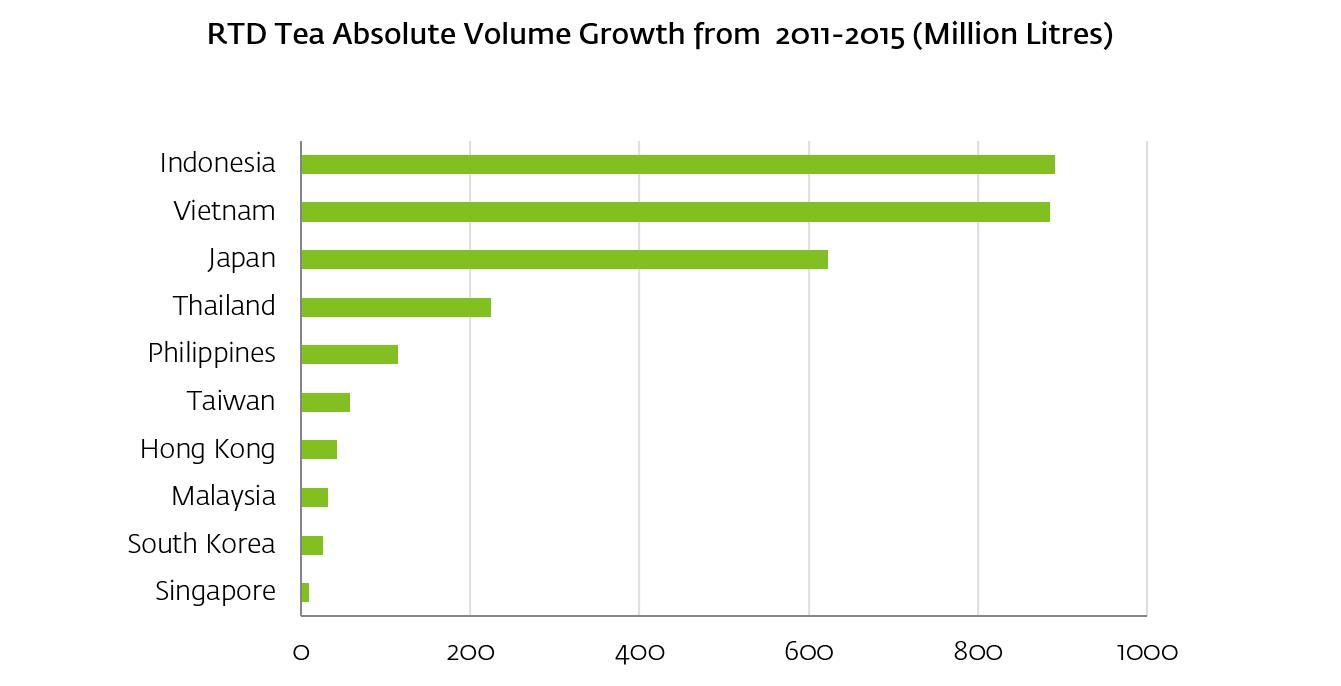

Euromonitor report: RTD Tea in Asia Pacific, May 2017

Looking at the RTD tea market in Asia, Indonesia is the country with the biggest volume growth from 2011 to 2015, with a forecasted CAGR growth of 5.8% from 2016 to 2021. With the rest of Asia facing slow growth, many international companies are looking at growing their share in Indonesia. We have seen new market entries or heavy investment into R&D and infrastructure development from international companies like Coca-Cola, Asahi Group, Suntory Group, and Ichitan in recent years.

The RTD tea market in Indonesia has traditionally been dominated by a few big local brands, namely Tehbotol Sosro, Teh Pucuk Harum, and Teh Gelas. In a market where local preferences are often misunderstood, can international brands gain traction among Indonesian consumers? For that, let us continue to examine and understand the Indonesian market and what makes their cup of tea.

Shifting trends in RTD packaging design in Indonesia

With the huge importance placed on packaging for FMCG by many, we have to, of course, review the packaging of various tea brands in the market. Different from the biscuits category in Malaysia and the feminine hygiene category in Japan, we predominantly see many RTD tea packaging with the use of brown, red, and green colors to literally bring out the color of tea, as well as a focus on bringing forth the pureness and lightness of tea when compared with carbonated drinks. With a shift in consumer preference from carbonated drinks to healthier tea options, we are starting to see the ‘Energetic Boost’ code (a frequently-used code in the carbonated drinks category) being adopted into the RTD tea category as well. Tea is no longer just for quenching thirst or simply a breath of freshness: Frestea, a brand under the Coca-Cola Company, is seen to inject vibrancy, energy and excitement into the RTD tea category.

Packaging design for Mytea

In terms of packaging, we see a code-breaking design from Mytea with the use of black color and simple curves. While tea leaves are still being featured, the simplicity of the design brought forth the authenticity and focus on the tea without other distractions. Instead of playing on the shape of the bottle to portray a healthier, slimmer effect of tea, Mytea uses clean curve lines to portray a slimmer silhouette. With this code-breaking design, it definitely helps Mytea to stand out on the shelves among the rest of the competitors.

While packaging is important, it does not guarantee the success of a brand. The success of a brand is also dependent upon many other factors including taste of the product, positioning, pricing, communication with consumers, route to market, and others. Considering this we have distilled down to 5 key growth factors for RTD tea in Indonesia.

Based on the insights that Indonesians love eating throughout the day, and enjoy sweet drinks along with the spicy food, Tehbotol has positioned itself as the beverage companion for meals since 2006. Tehbotol’s tagline brought out exactly this point – “Apapun makanannya minumnya Teh botol Sosro” (“Whatever you are eating, drink Tehbotol”). The tagline is simple and straightforward and everyone, regardless of education level, will be able to understand.

PT Sinar Sosro played the game of not over-stretching its hero brand very well. Tehbotol Sosro, bottled black tea with a hint of Jasmine, has stayed true to its core since it was developed in 1974. The company has chosen to launch new products like carbonated tea, fruit tea and juice drinks under other brands like TEBS, Fruit Tea and Happy Jus respectively. In the minds of consumers, Tehbotol is still the authentic sweetened black tea brewed from tea leaves, just the way they remembered it 4 decades ago. Sometimes, single-minded association is one of the best ways to help you gain top-of-mind recall within a category.

The move to keep the Tehbotol brand focused on black tea has also served the company well in the aspect of reducing product failure risk that might have impacted the Tehbotol brand equity built over the year. Instead, new products are being endorsed by the parent company, PT Sinor Sosro, a practice common in the beverage industry.

Being a country that is ranked as the sixth largest producer of tea globally, it is no surprise that Indonesians have a tea-drinking habit that goes way back in time. What is different is that there is no fixed time for tea in Indonesia. Tea is not only reserved for the afternoon like in Britain, nor does it have a ritual-like Japanese matcha. Indonesians have tea together with their meals or snacks throughout the day, hence opening up more occasions for consumption.

Traditionally sold in returnable glass bottles, RTD tea has developed into many different packaging sizes that fit every usage occasion, from big 1 liter PET bottles for family meal sharing to 150ml pouch format.

To cater to habit changes in regards to higher purchasing frequency, as well as in an attempt to make the price more affordable, Teh Gelas has even developed a smaller 250ml PET bottle that fits easily into the grip of the office lady or the pocket of men’s shirts for on-the-go consumption.

Tehbotol and Teh Galas have different packaging sizes

Some would agree with the vital importance of distribution channels, especially in developing countries with hard-to-reach places. With the widespread availability and physical products being present almost everywhere from billboards to in-store posters to availability at eateries, it delivers the impression that it is a popular brand that is highly sought after, and therefore prompted the action of “I should be drinking this”.

In our FMCG market entry research for ‘Es Teh,’ we believe that this is where big local and regional players tend to have an advantage over international companies when it comes to route-to-market and penetration. While modern trade is increasingly becoming the preferred channel for RTD beverages in developed cities in the likes of Jakarta, Yogyakarta, and Surabaya, the majority of the masses still get their tea from mom-and-pop stores, warung eateries, and cafeterias, especially in rural areas in Indonesia.

As mentioned earlier, Es Teh is a beverage that goes well with spicy Indonesian cuisine. To reach out to more of the masses, brand owners go via the B2B route of supplying to F&B establishments and fast food restaurants. Popular fast food chains like KFC, McDonald’s, and Es Teler 77 serve Tehbotol and have regular promotions that feature Tehbotol as the default drink that comes with the meal. Leveraging the network of these F&B establishments, the availability of their brands has increased drastically almost overnight.

Tehbotol leverages the network of established restaurants

In a survey conducted recently, Tehbotol has the highest unaided brand recall of 78% among the respondents, and this is not the result of pure advertising or digital marketing. Social media engagement, paid advertisement, sponsored events, product placement in local dramas, community events and widespread channel availability collectively sustains the brand presence in the life of these consumers. See it once, see it twice and it may be hidden somewhere in the back of your head. But if you were to see the brand umpteen times, at every corner you turn, the brand will be at the front of your recall. This is exactly the “bombardment strategy” that Tehbotol has adopted, positioning itself as the preferred companion for any meal across various marketing channels.

The survey results provide supporting evidence for our FMCG market entry research for “Es Teh”, emphasizing the importance of maintaining a consistent message regardless of the marketing medium.

While Coca-Cola is an international company, it has won over some of the RTD tea market shares with the Frestea brand which was launched in Indonesia in 2002. In fact, it is interesting to know that most Indonesians did not realize that Frestea is not a local brand. How is that so? Besides being manufactured in Indonesia, all its advertisements and communications were done in Bahasa Indonesian, featuring Indonesians in scenes that are familiar to them.

Coca-Cola’s Frestea brand communication

Based on our FMCG market entry research, the RTD tea industry in Indonesia definitely has room for more players like Asahi Group, Suntory Group, and Ichitan, especially when we see a trend towards healthier options in the likes of less sugar, sugarless green tea, and tea with superfood basil seed. However, consumer behavior in Indonesia is quite different in Indonesia and what works in other regions of the world may be rejected by consumers intent on the local dimensions.

To gain a foothold in the Indonesian market, these “new brands” need to have a deeper understanding of the consumers, from consumption scenarios to general lifestyle habits and preferences, beginning with these 5 key growth factors. A clear understanding of the competitive landscape will also allow the brand to identify potential code-breaking differentiation to stand out from the rest. After all, localization is not as simple as translating all existing materials, communication, and packaging to the local language, though deep down, we secretly wished it to be that way.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.