Dive into the intricate world of alcohol branding in China, where consumption habits span diverse occasions—from celebratory weddings to family gatherings during the New Year and deal-closing moments in business. Alcohol plays a pivotal role as a business facilitator, particularly at lavish banquets attended by top-level leaders and bureaucrats. Explore the multifaceted dynamics of alcohol branding in a culture where libations intertwine seamlessly with social, familial, and business contexts.

Historically, alcohol branding in China primarily targeted high-income, status-conscious consumers, with a specific focus on the mature clientele, as reflected in the average age of 39 for baijiu consumers. However, a notable shift is underway as both domestic and foreign spirits brands adapt their strategies to appeal to a broader demographic, including a growing emphasis on engaging younger adults. Explore the evolving landscape of alcohol branding as the industry responds to changing consumer dynamics and embraces a more diverse target audience.

Why are alcohol brands adjusting their positioning?

In the last few years, both foreign and domestic alcohol labels have switched their brand messages, product design and communication strategy in order to reach Chinese urban millennials. Two reasons can explain this:

How are they doing it?

In the current landscape, both foreign and domestic alcohol brands are strategically adjusting by lowering price points to counteract declining consumption among high-ranking officials and premium consumers. While appealing to the cost-conscious young middle-class segment, a lower price alone isn’t sufficient for building brand awareness and loyalty. Recognizing this shift, renowned labels are intensifying their marketing endeavors to meet the expectations of this evolving demographic, aiming to establish stronger brand connections and loyalty within this dynamic market. Explore the changing strategies in alcohol branding as brands navigate the nuances of a shifting consumer landscape.

They say you shouldn’t judge a book by its cover, however when it comes to alcohol packaging, Chinese consumers are very likely to judge a bottle by its wrapper. Baijiu manufacturers were the first in the industry to modernize and give a new youthful look to their products. The earliest example of this trend dates back to 2011, when Sichuan-based baijiu producer 我是江小白 (I am Jiang Xiaobai) hit the shelves with its bright, colorful bottles displaying a young cartoon character as the brand’s mascot.

In the same vein, historic liquor producer Luzhou Laojiao 泸州老窖 tried to reinvent the traditional perception of bajiu in 2014, which was until then a very dusty image. That year they unveiled their Rose Edition which came in a fashionable bold red or bright blue packaging resembling a perfume bottle.

Limited editions have also proved to be efficient ways for brand to test the waters of appealing to younger audiences. Research showed, for instance, that Chinese beer lovers complained that the usual bottle’s neck was too thin and the rim was too small to properly enjoy a drink with friends: last year, Tsingtao sought to solve this problem by flipping its bottles upside down, turning the base into a glass-sized opening and allowing drinkers to go bottoms-up more easily.

In recent years, we have also noticed some changes in the choice of taglines: brands adjusted their messages by using Internet slang or relating to young urbanites’ life aspirations. Despite its lack of heritage and history, Chinese brand I am Jiang Xiao Bai successfully managed to appeal to this new segment. With the slogan “I am Jiang Xiao Bai, life is simple” (我是江小白,生活很简单), the brand found a powerful way to resonate with Chinese young people’s thirst for a simple life, free from the social pressure to buy a house, find a good job and get married as soon as they graduate from university. The brand also created dozens of ads and customised bottle packaging, inviting consumers to recall the fond memories of their youth around a glass of baijiu.

Wuliangye, China’s largest baijiu producer in terms of volume, is progressively repositioning itself with new products in order to appeal to Chinese youngsters. In 2015, they launched a new range specifically dedicated to party goers, hoping, as their tagline suggests, to become youngsters’ go-to choice in clubs and bars.

Foreign manufacturers are also hopping on the bandwagon, with recent examples including French cognac producer Remy Martin and its latest campaign “One Life, Live Them” (一生,活出不止一生), which encourages consumers to pursue their dreams and passion without setting restricting boundaries and simply doing what is conventionally expected of them, an effective message for millennials who have an increasingly strong sense of individuality.

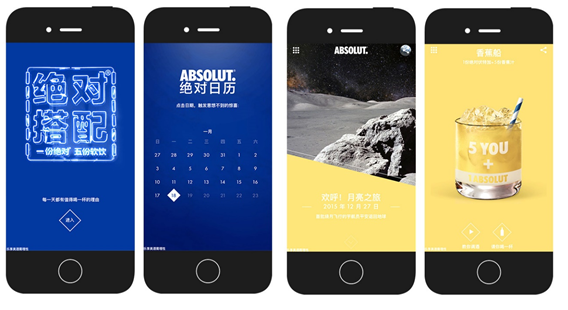

A common strategy employed by well-established foreign alcohol labels in China has been to leverage the power of social media to increase brand awareness. Swedish vodka maker Absolut can be considered as a newcomer on the Chinese market, and tapped into the potential of limited editions and social engagement to appeal to a younger audience. We already talked in the past about one of the brand’s most notable attempt to localize its products with the China-exclusive “72 Transformations” (72变) bottle, a cultural reference to the Monkey King character’s ability to undergo 72 transformations in the Chinese mythological novel Journey to the West.

After establishing a successful presence on China’s major digital channels WeChat and Weibo, the brand is now inviting the newly-converted vodka lovers to create their own cocktails through its mobile mini-site themed “Everyday there’s a good reason to have a glass” (每一天都有值得喝一杯的理由), a good way to engage with customers and encourage them to be bold and creative in the ways they experience vodka drinking.

Another example comes from Cognac manufacturer Hennessy who was among the first brands in 2011 to launch a specific line named Classivm aimed at wooing young Chinese drinkers. Following its “I Can Shine” campaign held at various clubs and bars across the country in 2013, the brand recently organized an exclusive offline event in Shanghai for the launch of a new flashy, compact 200ml bottle designed to enable consumers to party whenever, wherever they want.

Last month, Hennessy created the buzz around this new product by installing huge neon green doors around the city, piquing the curiosity of locals wondering what could be hiding behind them.

The doors were actually an invitation to find a hidden space in Shanghai’s Former French Concession where everyone could experience the Hennessy Classivm universe in a variety of ways. For instance, each bottle came with a QR code which when scanned would change the music displayed in the room, letting people becoming their own DJ. Also, an interactive screen allowed consumers to complete a quick test that created unique cocktails based on their personality.

Conclusion

In the quest to capture the attention of younger Chinese consumers, both foreign and domestic spirits producers are adapting their branding strategies. However, challenging the dominance of beer as the preferred alcoholic beverage in this segment requires sustained efforts. The key lies in consistently crafting creative campaigns that culturally resonate, educating consumers on drinking rituals, and promoting a lifestyle aligned with the aspirations of today’s Chinese millennials. Brands embracing this approach are poised for success in the years ahead, as they connect authentically with the evolving preferences and lifestyles of the target demographic. Explore the dynamic landscape of alcohol branding as brands navigate the path to resonate with a younger audience.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.