As Uber reshaped transportation dynamics globally in 2011, its influence echoed in the Asian market, giving rise to similar platforms like Didi, Grab, and Go-Jek. While Uber’s worldwide business model extends beyond transportation, its focus in Asia centers on basic transport services. With challenges in China and Italy, the question arises: Will Uber shift its brand-building efforts to Southeast Asia markets like Singapore, Malaysia, and Indonesia? Explore the evolving landscape of global ride-sharing and anticipate the next moves in Uber’s brand building strategy.

Originating in Malaysia, Grab distinguishes itself by emphasizing “higher local relevance” in Southeast Asia. Unlike Uber’s positioning as “everyone’s private driver,” Grab’s focus is on swiftly addressing the persistent challenge of cab availability. Discover how Grab’s unique strategy combines both cabs and private cars under the JustGrab feature, showcasing a brand-building effort that resonates with the specific needs and pain points of consumers in Southeast Asian cities.

Discover how Grab reinforces its brand building efforts with the recent launch of JustGrab on March 29. This innovative feature combines GrabCar’s private cars with GrabTaxi’s extensive fleet, emphasizing the core value of “speed.” By offering passengers one-tap access to the nearest available ride, JustGrab significantly reduces waiting times. However, it’s essential to note that with this enhancement comes the introduction of dynamic pricing, akin to Uber’s “surge pricing.” Explore the evolution of Grab’s brand building as it continues to address user needs while navigating the challenges associated with pricing dynamics in the ride-hailing landscape.

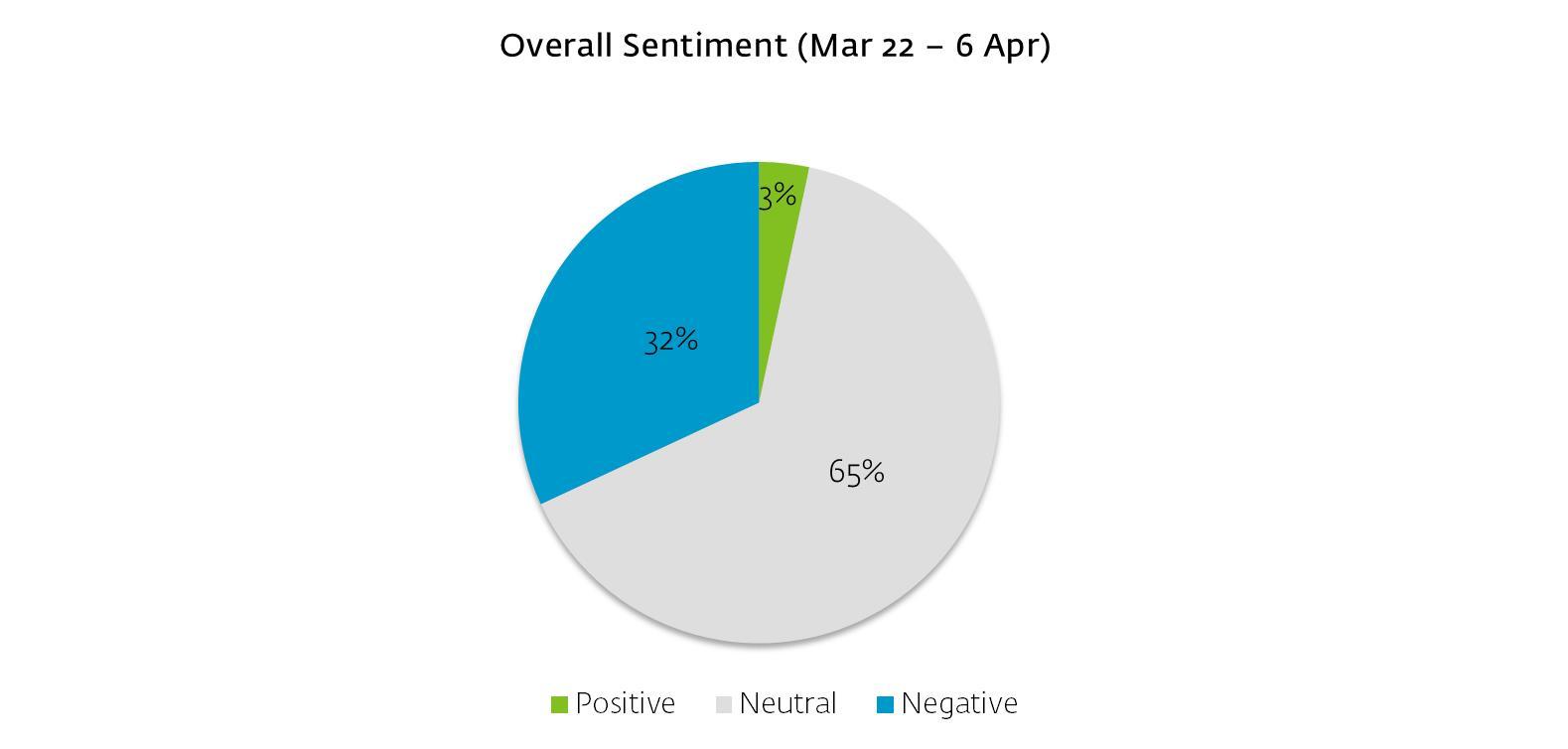

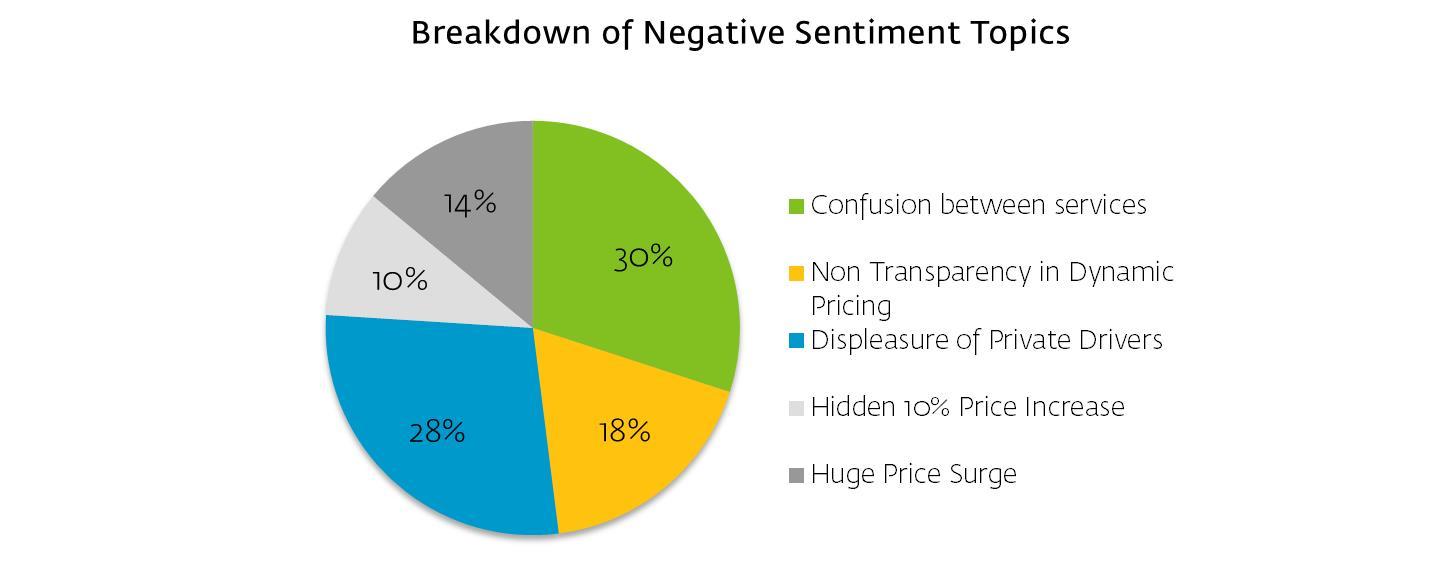

As with the introduction of any new initiative that disrupts usual habits, Grab’s dynamic pricing and the new JustGrab feature seems to have ruffled the feathers of some. A review of the online discussion on JustGrab revealed a high percentage of negative sentiment (32%).

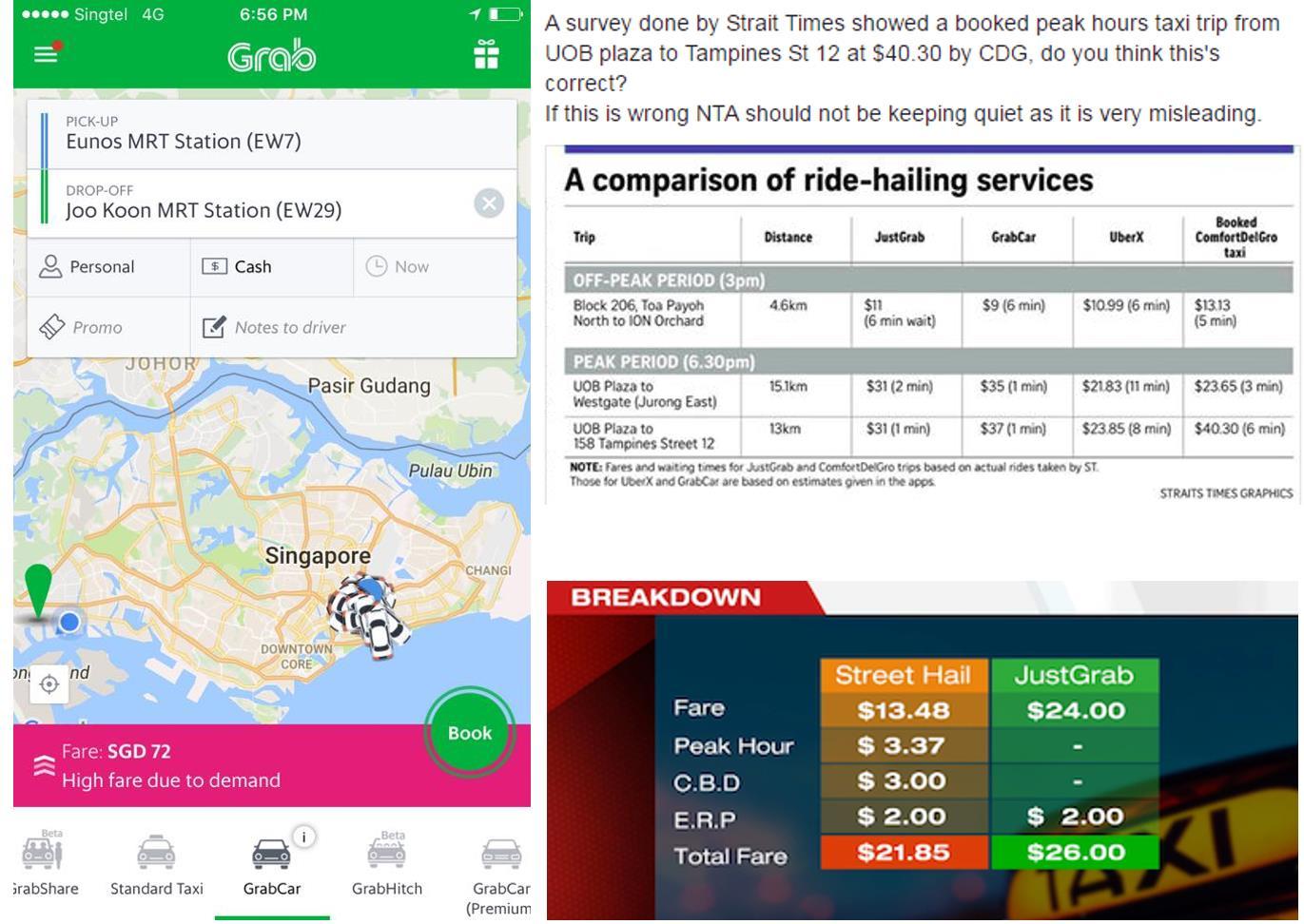

We see a cloud of confusion hovering around many users, with close to a third expressing confusion between GrabCar, GrabTaxi and JustGrab. In a market where consumers are used to benefitting from the price war, the new dynamic pricing scheme has also drawn much discussion online with 42% of the grouses resolving around price-hike related issues. What followed suit were numerous price comparison discussions and analysis between the different operators, which once again has brought the focus back to price.

While the new initiative created a momentarily increase in overall ride availability and therefore its value proposition based on speed, we cannot help but wonder if the non-transparent surge pricing would bring back the habits of “disappearing drivers” just before peak hours, or of drivers waiting for the bookings just so in order to increase their yield.

As a platform that taps social resources, especially one that emphasizes on speed, the widespread availability of drivers is one of the key contributors to the success of the platform.

While consumers are given tons of promotional discount codes to distract their attention from the effects of surge pricing, private car drivers’ displeasure seems to be brewing with the increased competition from cabs. As a social sharing platform that depends on both drivers and riders to function properly, having a strong connection to both groups is paramount to the long-term success.

As expressed by one of the drivers in an online forum, the introduction of JustGrab is seen as “a direct competitor of GrabCar” and “a behavior of betrayal on the fleet of private car drivers”. This seed of distrust is certainly not something to ignore, unless Grab is planning a step back to the days of “GrabTaxi” – as a cab-hailing platform.

Explore the essence of effective brand building exemplified by Go-Jek in Indonesia. Beyond facilitating vocational license applications and managing logistical aspects, Go-Jek forges a profound connection with its driver-partners. Through an emotional campaign, Go-Jek positions itself as a service deeply rooted in Indonesian culture, crafted for Indonesians, and dedicated to transforming lives. By addressing the challenges faced by locals and enhancing the well-being of drivers and their families, Go-Jek builds loyalty among its fleet. Remarkably, this driver-centric approach not only resonates with riders but has propelled Go-Jek to become Indonesia’s top online-service booking platform. Witness the power of strategic brand building that transcends consumer focus to cultivate a holistic and enduring brand connection.

There is much more that ride-sharing companies must do to earn brand loyalty besides engaging in a price war. Continuous price war is just going to get users switching between platforms, until the day comes when surge pricing gets so extreme that consumers are forced to abandon the platforms for other options – which might not be impossible with the pace of technological development that we see today. After all, brand building is about winning hearts, not just pockets.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.